28 Aug 2024

Guides

Cost Volume Profit Analysis (CVP): Explaining everything you need to know

Cost Volume Profit Analysis (CVP): Explaining everything you need to know

Cost Volume Profit analysis is a crucial financial tool that examines how changes in costs, volume, and prices affect a company's profit.

Cost Volume Profit (CVP) analysis is a fundamental financial planning tool that helps businesses understand the relationships between costs, sales volume, and profits. By examining how changes in these variables affect overall financial performance, companies can make more informed decisions about pricing, production levels, and resource allocation.

Understanding the Basics of CVP Analysis

CVP analysis is built on several key assumptions and components that form the foundation of this financial tool:

Fixed Costs: These are expenses that remain constant regardless of production volume or sales. Examples include rent, insurance, and salaries for permanent staff.

Variable Costs: These are expenses that change in proportion to production or sales volume. Examples include raw materials, direct labor, and sales commissions.

Sales Price: The amount charged per unit of product or service.

Sales Volume: The number of units sold or services provided.

Total Revenue: The product of sales price and sales volume.

Contribution Margin: The difference between the sales price and variable cost per unit.

CVP analysis works on a straightforward idea: it assumes that as you make or sell more, your costs and revenue change in a predictable, straight-line pattern. This makes the math easier and helps you make quick estimates. But keep in mind, the real world isn't always this neat and tidy. Sometimes costs might jump unexpectedly, or sales might not grow as smoothly as the analysis suggests. It's a useful tool, but it's more of a helpful guideline than an exact science.

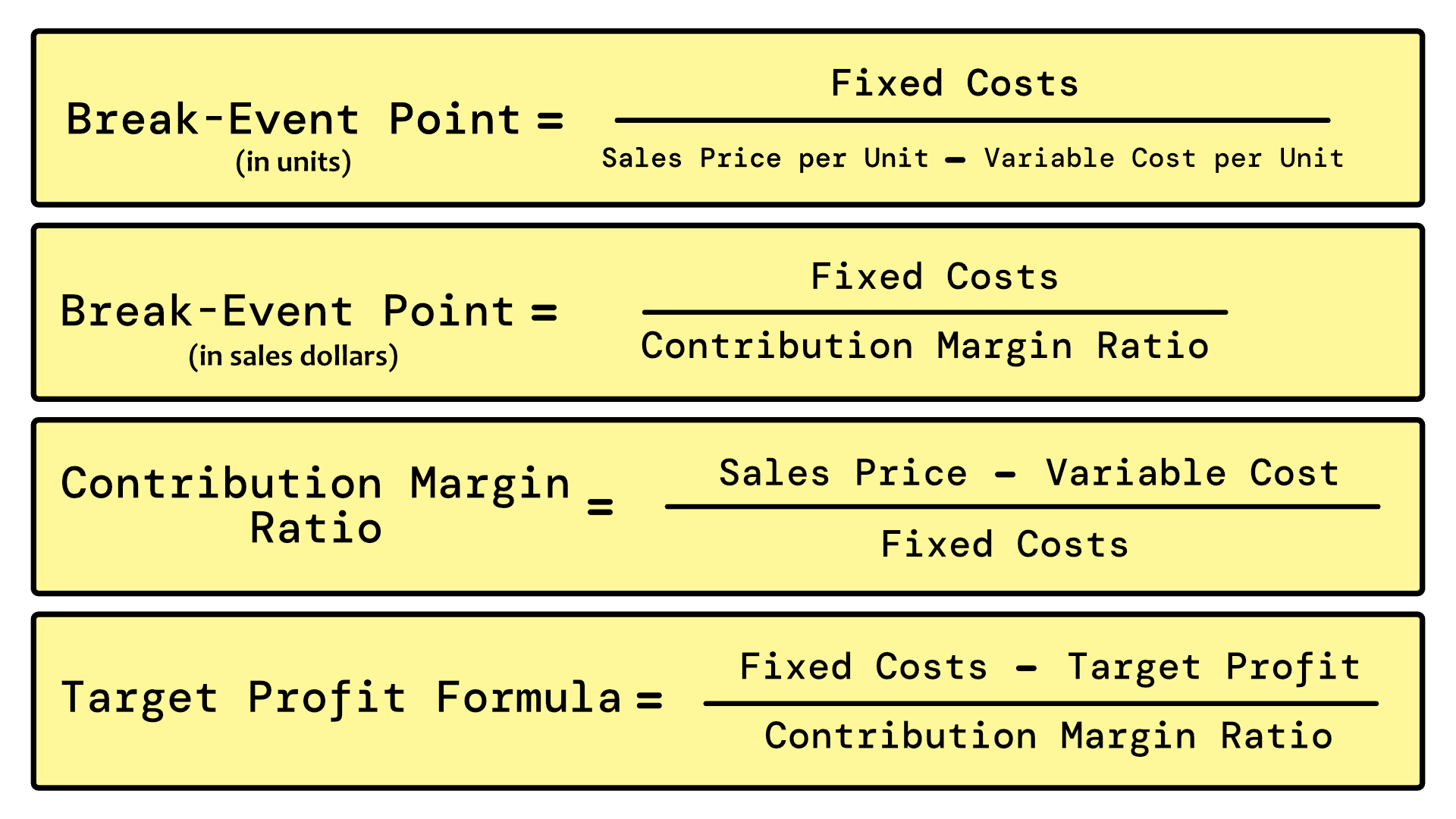

Key Formulas in CVP Analysis

To effectively use CVP analysis, it's essential to understand and apply several key formulas:

Break-Even Point (in units) = Fixed Costs / (Sales Price per Unit - Variable Cost per Unit)

Break-Even Point (in sales dollars) = Fixed Costs / Contribution Margin Ratio

Contribution Margin Ratio = (Sales Price - Variable Cost) / Sales Price

Target Profit Formula: (Fixed Costs + Target Profit) / Contribution Margin per Unit

These formulas allow businesses to calculate critical points such as the break-even point (where total revenue equals total costs) and determine the sales volume needed to achieve specific profit targets.

Practical Applications of CVP Analysis

CVP analysis has numerous practical applications in business decision-making:

Pricing Strategies: By understanding how price changes affect profitability, companies can optimize their pricing to maximize profits or market share.

Production Planning: CVP analysis helps determine optimal production levels to meet profit goals or minimize losses.

Cost Management: By identifying the impact of fixed and variable costs on profitability, businesses can focus on controlling the most influential cost factors.

Break-Even Analysis: Determining the point at which a product or service becomes profitable is crucial for evaluating new ventures or product lines.

Sensitivity Analysis: CVP analysis allows companies to model different scenarios and assess the impact of changes in costs, prices, or sales volume on profitability.

Limitations and Considerations

While CVP analysis is a powerful tool, it's important to recognize its limitations:

Assumption of Linearity: CVP analysis assumes a linear relationship between costs and volume, which may not hold true in all cases, especially at extreme production levels.

Single Product Focus: Traditional CVP analysis is designed for single-product scenarios, making it challenging to apply to multi-product businesses without modifications.

Short-Term Perspective: The analysis typically focuses on short-term decisions and may not account for long-term strategic implications.

Simplified Cost Structure: CVP analysis often simplifies cost structures, potentially overlooking complexities in real-world scenarios.

Market Demand Assumptions: The analysis assumes that all units produced can be sold, which may not always be the case in dynamic market conditions.

Enhancing CVP Analysis with Modern Tools

While traditional CVP analysis provides valuable insights, modern financial tools can significantly enhance its effectiveness. Platforms like unmess offer advanced capabilities that address some of the limitations of traditional CVP analysis:

Granular Cost Attribution: unmess calculates unit costs at a customer level, providing a more accurate picture of cost structures than traditional CVP models.

Dynamic Analysis: By assigning costs to each customer action, unmess allows for real-time updates to CVP models, reflecting the most current data.

Multi-Product Capability: The platform's ability to build a P&L from the ground up makes it easier to apply CVP principles to complex, multi-product businesses.

Integration of Non-Linear Relationships: Advanced analytics can incorporate non-linear cost and revenue relationships, addressing a key limitation of traditional CVP analysis.

Improved Decision Support: By providing more detailed and accurate cost information, tools like unmess enable more informed decision-making in pricing, production planning, and resource allocation.

Conclusion:

Cost Volume Profit analysis remains a cornerstone of financial planning and decision-making for businesses of all sizes. Its ability to provide clear insights into the relationships between costs, sales volume, and profitability makes it an invaluable tool for managers and financial professionals.

While traditional CVP analysis has its limitations, the integration of modern financial tools like unmess can significantly enhance its effectiveness. By providing more granular, real-time cost and profitability data, unmess enables businesses to apply CVP principles with greater accuracy and flexibility. This enhanced approach to CVP analysis can lead to more informed decisions, optimized operations, and ultimately, improved financial performance.

As businesses continue to navigate complex financial landscapes, combining the foundational principles of CVP analysis with advanced cost attribution tools will be key to maintaining a competitive edge and driving sustainable growth.

Cost Volume Profit (CVP) analysis is a fundamental financial planning tool that helps businesses understand the relationships between costs, sales volume, and profits. By examining how changes in these variables affect overall financial performance, companies can make more informed decisions about pricing, production levels, and resource allocation.

Understanding the Basics of CVP Analysis

CVP analysis is built on several key assumptions and components that form the foundation of this financial tool:

Fixed Costs: These are expenses that remain constant regardless of production volume or sales. Examples include rent, insurance, and salaries for permanent staff.

Variable Costs: These are expenses that change in proportion to production or sales volume. Examples include raw materials, direct labor, and sales commissions.

Sales Price: The amount charged per unit of product or service.

Sales Volume: The number of units sold or services provided.

Total Revenue: The product of sales price and sales volume.

Contribution Margin: The difference between the sales price and variable cost per unit.

CVP analysis works on a straightforward idea: it assumes that as you make or sell more, your costs and revenue change in a predictable, straight-line pattern. This makes the math easier and helps you make quick estimates. But keep in mind, the real world isn't always this neat and tidy. Sometimes costs might jump unexpectedly, or sales might not grow as smoothly as the analysis suggests. It's a useful tool, but it's more of a helpful guideline than an exact science.

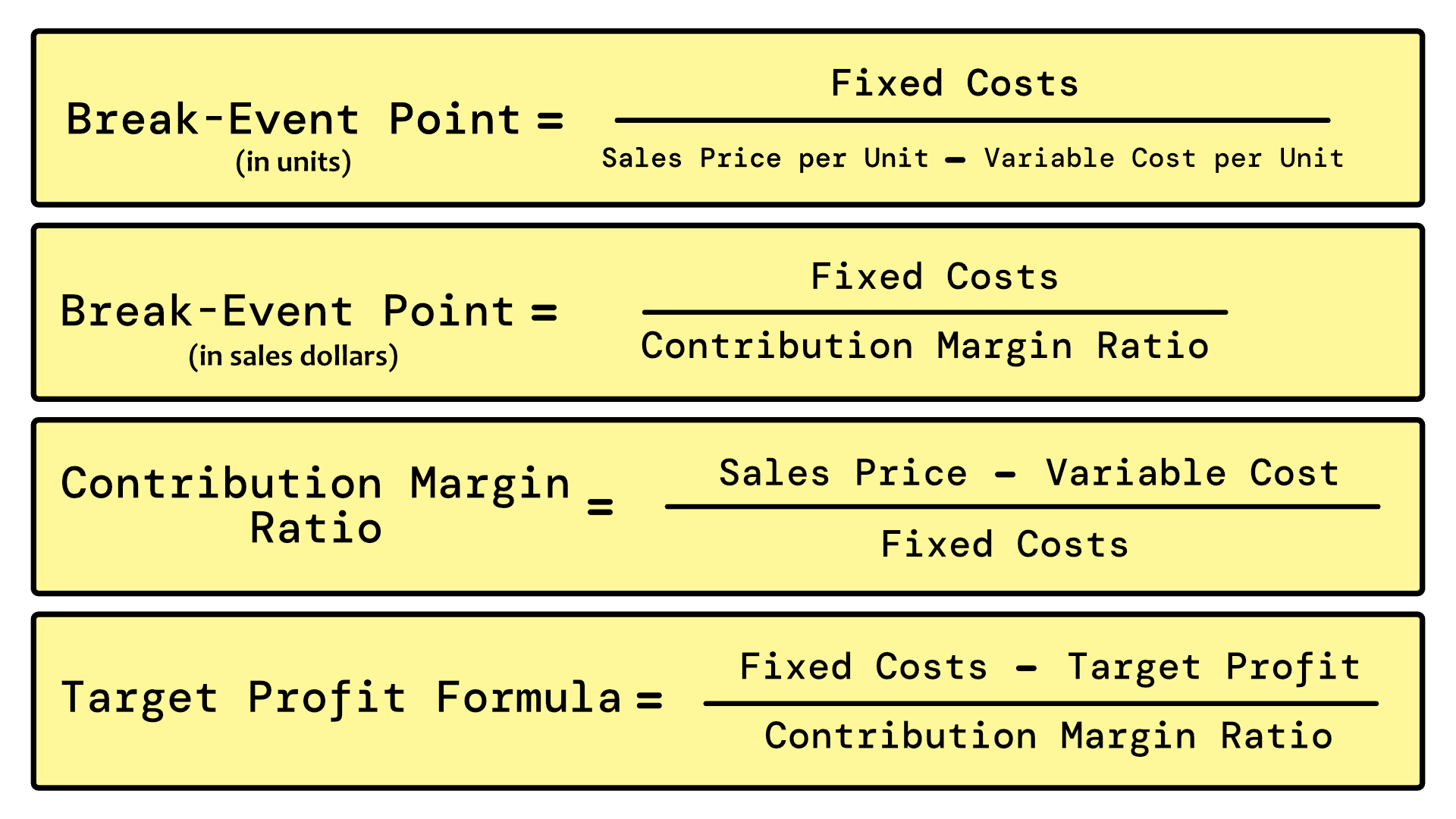

Key Formulas in CVP Analysis

To effectively use CVP analysis, it's essential to understand and apply several key formulas:

Break-Even Point (in units) = Fixed Costs / (Sales Price per Unit - Variable Cost per Unit)

Break-Even Point (in sales dollars) = Fixed Costs / Contribution Margin Ratio

Contribution Margin Ratio = (Sales Price - Variable Cost) / Sales Price

Target Profit Formula: (Fixed Costs + Target Profit) / Contribution Margin per Unit

These formulas allow businesses to calculate critical points such as the break-even point (where total revenue equals total costs) and determine the sales volume needed to achieve specific profit targets.

Practical Applications of CVP Analysis

CVP analysis has numerous practical applications in business decision-making:

Pricing Strategies: By understanding how price changes affect profitability, companies can optimize their pricing to maximize profits or market share.

Production Planning: CVP analysis helps determine optimal production levels to meet profit goals or minimize losses.

Cost Management: By identifying the impact of fixed and variable costs on profitability, businesses can focus on controlling the most influential cost factors.

Break-Even Analysis: Determining the point at which a product or service becomes profitable is crucial for evaluating new ventures or product lines.

Sensitivity Analysis: CVP analysis allows companies to model different scenarios and assess the impact of changes in costs, prices, or sales volume on profitability.

Limitations and Considerations

While CVP analysis is a powerful tool, it's important to recognize its limitations:

Assumption of Linearity: CVP analysis assumes a linear relationship between costs and volume, which may not hold true in all cases, especially at extreme production levels.

Single Product Focus: Traditional CVP analysis is designed for single-product scenarios, making it challenging to apply to multi-product businesses without modifications.

Short-Term Perspective: The analysis typically focuses on short-term decisions and may not account for long-term strategic implications.

Simplified Cost Structure: CVP analysis often simplifies cost structures, potentially overlooking complexities in real-world scenarios.

Market Demand Assumptions: The analysis assumes that all units produced can be sold, which may not always be the case in dynamic market conditions.

Enhancing CVP Analysis with Modern Tools

While traditional CVP analysis provides valuable insights, modern financial tools can significantly enhance its effectiveness. Platforms like unmess offer advanced capabilities that address some of the limitations of traditional CVP analysis:

Granular Cost Attribution: unmess calculates unit costs at a customer level, providing a more accurate picture of cost structures than traditional CVP models.

Dynamic Analysis: By assigning costs to each customer action, unmess allows for real-time updates to CVP models, reflecting the most current data.

Multi-Product Capability: The platform's ability to build a P&L from the ground up makes it easier to apply CVP principles to complex, multi-product businesses.

Integration of Non-Linear Relationships: Advanced analytics can incorporate non-linear cost and revenue relationships, addressing a key limitation of traditional CVP analysis.

Improved Decision Support: By providing more detailed and accurate cost information, tools like unmess enable more informed decision-making in pricing, production planning, and resource allocation.

Conclusion:

Cost Volume Profit analysis remains a cornerstone of financial planning and decision-making for businesses of all sizes. Its ability to provide clear insights into the relationships between costs, sales volume, and profitability makes it an invaluable tool for managers and financial professionals.

While traditional CVP analysis has its limitations, the integration of modern financial tools like unmess can significantly enhance its effectiveness. By providing more granular, real-time cost and profitability data, unmess enables businesses to apply CVP principles with greater accuracy and flexibility. This enhanced approach to CVP analysis can lead to more informed decisions, optimized operations, and ultimately, improved financial performance.

As businesses continue to navigate complex financial landscapes, combining the foundational principles of CVP analysis with advanced cost attribution tools will be key to maintaining a competitive edge and driving sustainable growth.

Cost Volume Profit (CVP) analysis is a fundamental financial planning tool that helps businesses understand the relationships between costs, sales volume, and profits. By examining how changes in these variables affect overall financial performance, companies can make more informed decisions about pricing, production levels, and resource allocation.

Understanding the Basics of CVP Analysis

CVP analysis is built on several key assumptions and components that form the foundation of this financial tool:

Fixed Costs: These are expenses that remain constant regardless of production volume or sales. Examples include rent, insurance, and salaries for permanent staff.

Variable Costs: These are expenses that change in proportion to production or sales volume. Examples include raw materials, direct labor, and sales commissions.

Sales Price: The amount charged per unit of product or service.

Sales Volume: The number of units sold or services provided.

Total Revenue: The product of sales price and sales volume.

Contribution Margin: The difference between the sales price and variable cost per unit.

CVP analysis works on a straightforward idea: it assumes that as you make or sell more, your costs and revenue change in a predictable, straight-line pattern. This makes the math easier and helps you make quick estimates. But keep in mind, the real world isn't always this neat and tidy. Sometimes costs might jump unexpectedly, or sales might not grow as smoothly as the analysis suggests. It's a useful tool, but it's more of a helpful guideline than an exact science.

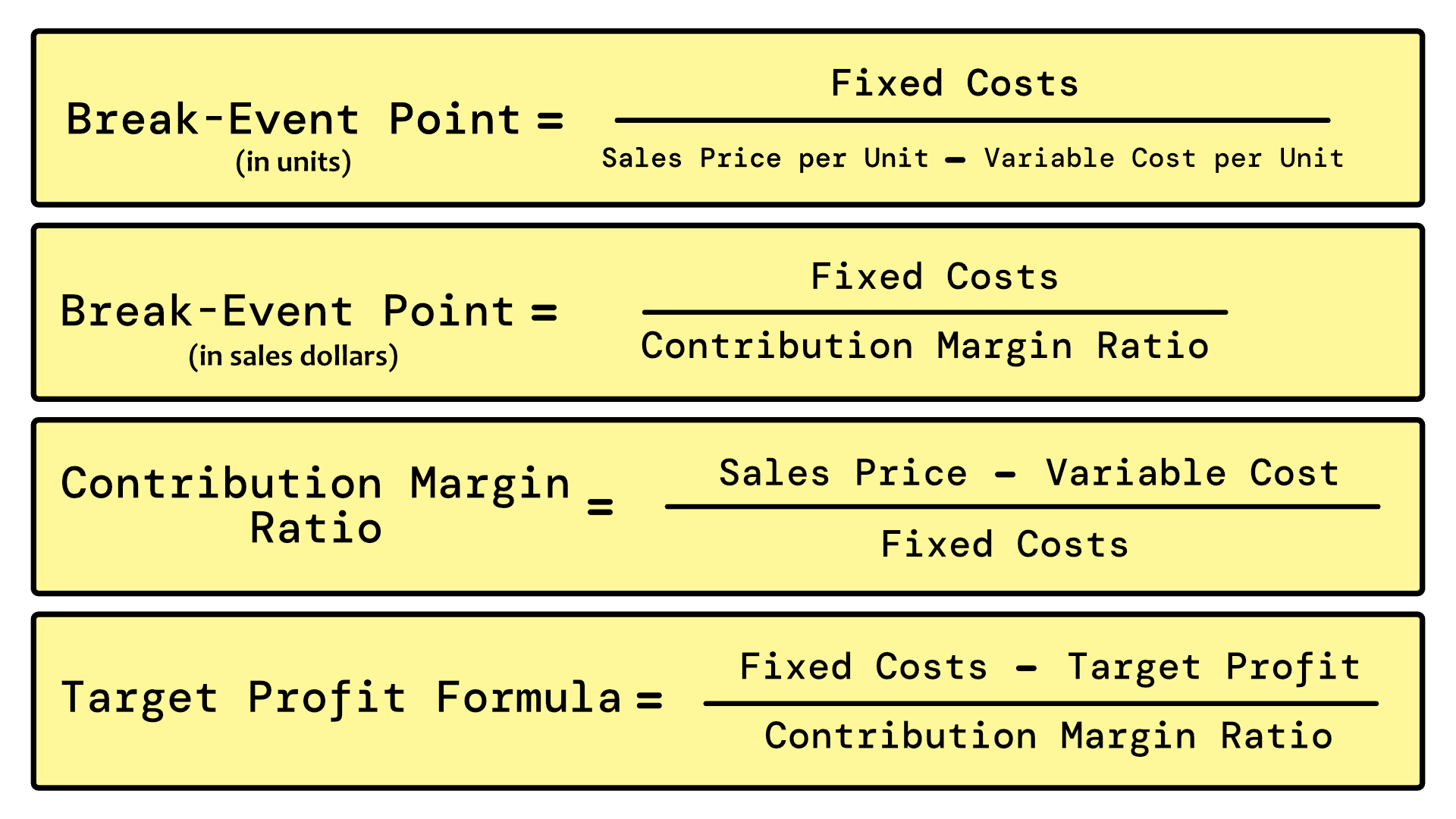

Key Formulas in CVP Analysis

To effectively use CVP analysis, it's essential to understand and apply several key formulas:

Break-Even Point (in units) = Fixed Costs / (Sales Price per Unit - Variable Cost per Unit)

Break-Even Point (in sales dollars) = Fixed Costs / Contribution Margin Ratio

Contribution Margin Ratio = (Sales Price - Variable Cost) / Sales Price

Target Profit Formula: (Fixed Costs + Target Profit) / Contribution Margin per Unit

These formulas allow businesses to calculate critical points such as the break-even point (where total revenue equals total costs) and determine the sales volume needed to achieve specific profit targets.

Practical Applications of CVP Analysis

CVP analysis has numerous practical applications in business decision-making:

Pricing Strategies: By understanding how price changes affect profitability, companies can optimize their pricing to maximize profits or market share.

Production Planning: CVP analysis helps determine optimal production levels to meet profit goals or minimize losses.

Cost Management: By identifying the impact of fixed and variable costs on profitability, businesses can focus on controlling the most influential cost factors.

Break-Even Analysis: Determining the point at which a product or service becomes profitable is crucial for evaluating new ventures or product lines.

Sensitivity Analysis: CVP analysis allows companies to model different scenarios and assess the impact of changes in costs, prices, or sales volume on profitability.

Limitations and Considerations

While CVP analysis is a powerful tool, it's important to recognize its limitations:

Assumption of Linearity: CVP analysis assumes a linear relationship between costs and volume, which may not hold true in all cases, especially at extreme production levels.

Single Product Focus: Traditional CVP analysis is designed for single-product scenarios, making it challenging to apply to multi-product businesses without modifications.

Short-Term Perspective: The analysis typically focuses on short-term decisions and may not account for long-term strategic implications.

Simplified Cost Structure: CVP analysis often simplifies cost structures, potentially overlooking complexities in real-world scenarios.

Market Demand Assumptions: The analysis assumes that all units produced can be sold, which may not always be the case in dynamic market conditions.

Enhancing CVP Analysis with Modern Tools

While traditional CVP analysis provides valuable insights, modern financial tools can significantly enhance its effectiveness. Platforms like unmess offer advanced capabilities that address some of the limitations of traditional CVP analysis:

Granular Cost Attribution: unmess calculates unit costs at a customer level, providing a more accurate picture of cost structures than traditional CVP models.

Dynamic Analysis: By assigning costs to each customer action, unmess allows for real-time updates to CVP models, reflecting the most current data.

Multi-Product Capability: The platform's ability to build a P&L from the ground up makes it easier to apply CVP principles to complex, multi-product businesses.

Integration of Non-Linear Relationships: Advanced analytics can incorporate non-linear cost and revenue relationships, addressing a key limitation of traditional CVP analysis.

Improved Decision Support: By providing more detailed and accurate cost information, tools like unmess enable more informed decision-making in pricing, production planning, and resource allocation.

Conclusion:

Cost Volume Profit analysis remains a cornerstone of financial planning and decision-making for businesses of all sizes. Its ability to provide clear insights into the relationships between costs, sales volume, and profitability makes it an invaluable tool for managers and financial professionals.

While traditional CVP analysis has its limitations, the integration of modern financial tools like unmess can significantly enhance its effectiveness. By providing more granular, real-time cost and profitability data, unmess enables businesses to apply CVP principles with greater accuracy and flexibility. This enhanced approach to CVP analysis can lead to more informed decisions, optimized operations, and ultimately, improved financial performance.

As businesses continue to navigate complex financial landscapes, combining the foundational principles of CVP analysis with advanced cost attribution tools will be key to maintaining a competitive edge and driving sustainable growth.