20 Aug 2024

Post

Profit Per Click: Revolutionizing Digital Marketing ROI for FP&A

Profit Per Click: Revolutionizing Digital Marketing ROI for FP&A

Profit Per Click enhances marketing ROI by combining financial and marketing data. Providing FP&A teams with insights for optimizing campaign profitability

Clicks, impressions, conversions - these metrics form the backbone of digital marketing analytics. However, for FP&A teams, these metrics often fall short in providing a complete picture of marketing's impact on the bottom line. That's where PrPC (Profit Per Click) analysis comes in, bridging the gap between marketing metrics and financial outcomes.

Understanding Profit Per Click

Profit Per Click is not to be confused with Pay Per Click, a common digital advertising model. Instead, PrPC in this context refers to the actual profit generated from each click in a digital marketing campaign. This metric goes beyond traditional ROI calculations by factoring in not just revenue, but also the costs associated with each click and subsequent customer actions.

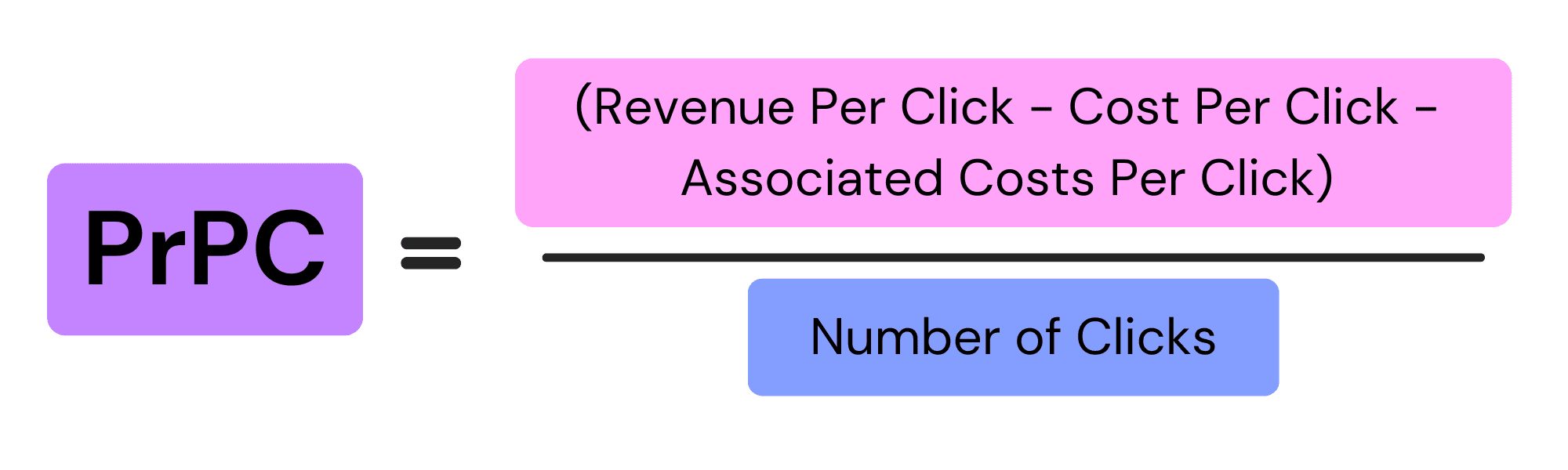

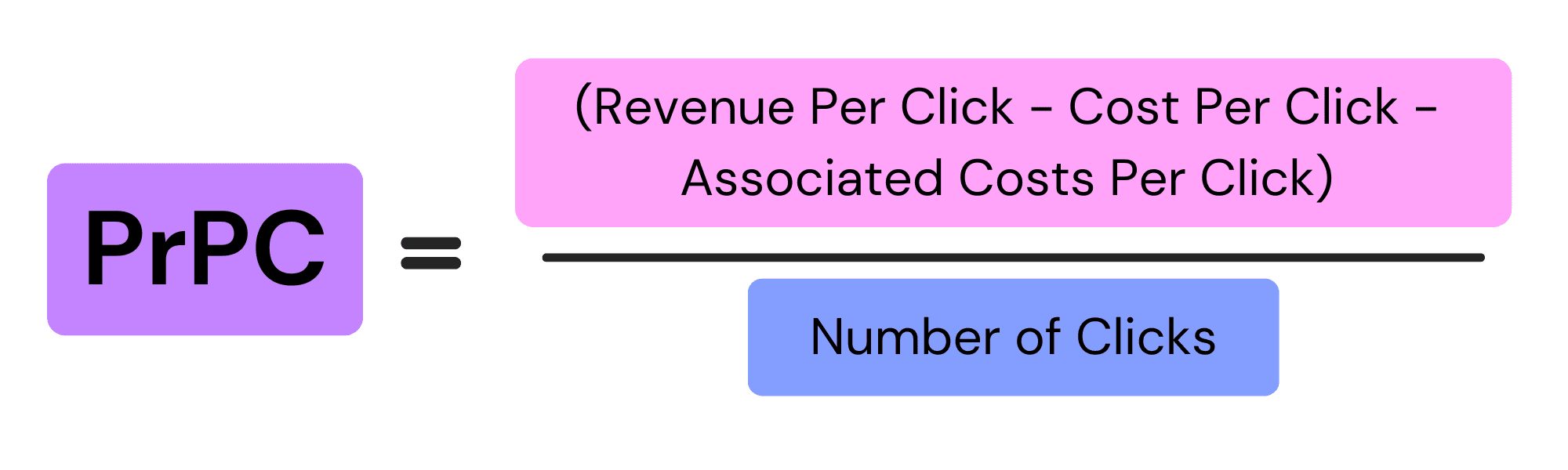

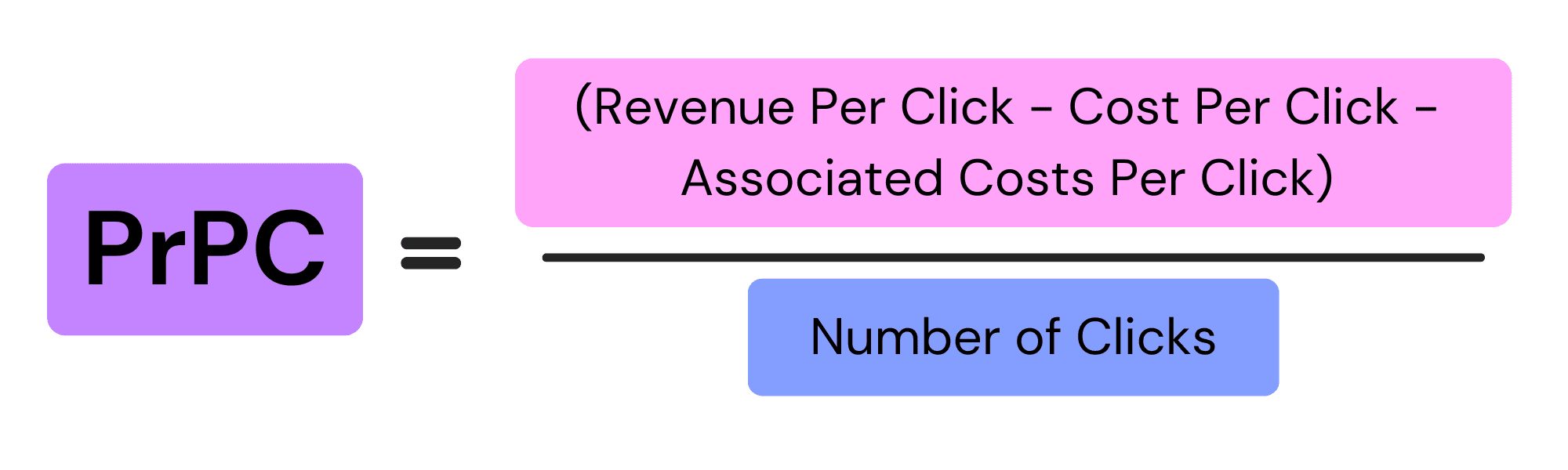

The formula for Profit Per Click is relatively straightforward:

Profit Per Click = (Revenue Per Click - Cost Per Click - Associated Costs Per Click) / Number of Clicks

This metric offers a deeper insight into campaign profitability by requiring marketers and financial analysts to consider all associated costs, not just the direct advertising spend.

Incorporating PrPC analysis into financial assessments ensures that marketing efforts are evaluated with a comprehensive understanding of their financial impact. This holistic approach helps to align marketing strategies with overall business goals, making it easier to optimize campaigns for true profitability.

Why Traditional ROI Falls Short

Traditional ROI calculations for digital marketing often focus on the direct relationship between ad spend and revenue generated. While this provides a basic understanding of campaign performance, it fails to account for several crucial factors:

Customer Acquisition Costs: Beyond the immediate cost of the click, there are often additional costs involved in converting a prospect into a customer.

Customer Lifetime Value: A campaign might have a low immediate ROI but lead to customers with high lifetime value.

Operational Costs: The costs of fulfilling orders, providing customer support, and other operational expenses are often overlooked in traditional ROI calculations.

Opportunity Costs: Resources allocated to one campaign could potentially have been used elsewhere, a factor not captured in simple ROI metrics.

Integrating customer-focused metrics into financial analysis can significantly enhance ROI by providing a more comprehensive view of profitability. These metrics offer valuable insights into the broader impact of customer acquisition and lifetime value on financial planning. For a deeper dive into this approach, explore our blog on Integrating Customer Metrics in Financial Reporting.

Implementing Profit Per Click Analysis

Implementing a Profit Per Click analysis requires collaboration between marketing, finance, and operations teams. Here's a step-by-step guide to getting started:

Data Integration: The first step is to integrate data from various sources, including marketing data (clicks, impressions, conversions), financial data (revenue, costs), and operational data (such as software licensing, customer support expenses, or cloud service costs).

Cost Attribution: Assigning costs to each stage of the customer journey—from the initial click to post-purchase support—requires a nuanced approach. This can be done using two primary methods:

Activity-Based Costing: This approach allocates costs based on specific activities that contribute to the customer journey. It considers the resources consumed at each stage, such as marketing efforts, customer engagement, and support activities. This method provides a more granular view of where costs are incurred.

Unit-Based Costing: In this method, costs are attributed based on the units of output, such as the number of clicks, conversions, or orders fulfilled. It's a more straightforward approach, offering clarity on the cost per unit at different stages of the journey.

Revenue Attribution: Determine how revenue is attributed to specific marketing actions. This might involve multi-touch attribution models to account for complex customer journeys.

Lifetime Value Calculation: Incorporate customer lifetime value into your calculations to account for long-term profitability.

Analysis and Reporting: Develop reports that clearly communicate Profit Per Click metrics, allowing for easy comparison across campaigns and channels.

FP&A teams can significantly boost the effectiveness of PrPC analysis by aligning it with product-led growth strategies. When financial planning is integrated with UX data, businesses can identify key touchpoints that drive the most profit, ultimately leading to better decision-making. You can explore this approach further in The CFO's Playbook for Product-Led Growth: Integrating Finance with UX.

Benefits of Profit Per Click for FP&A

For FP&A teams, Profit Per Click analysis offers several key benefits:

Improved Resource Allocation: By understanding the true profitability of different marketing channels and campaigns, FP&A teams can make more informed decisions about budget allocation.

Enhanced Forecasting: PrPC analysis provides a more accurate picture of the relationship between marketing spend and profitability, enabling more precise financial forecasting.

Better Alignment with Marketing: This approach bridges the gap between marketing metrics and financial outcomes, fostering better collaboration between marketing and finance teams.

Identification of Hidden Costs: The process of implementing PrPC analysis often reveals hidden costs in the customer acquisition and retention process, providing opportunities for optimization.

Long-term Strategic Planning: By incorporating customer lifetime value, PrPC analysis supports long-term strategic planning, aligning marketing efforts with overall business goals.

Challenges and Considerations

While Profit Per Click analysis offers significant benefits, it's not without challenges. Some key considerations include:

Data Quality: The accuracy of PrPC analysis is only as good as the data it's based on. Ensuring data quality across all integrated systems is crucial.

Attribution Complexity: In multi-channel marketing environments, accurately attributing profit to specific clicks can be complex.

Time Lag: There may be a significant time lag between a click and the realization of profit, particularly when considering customer lifetime value.

Implementation Costs: Setting up the systems and processes for PrPC analysis can require significant upfront investment.

Despite these challenges, the insights gained from Profit Per Click analysis can be transformative for businesses seeking to optimize their digital marketing efforts.

Conclusion

Profit Per Click analysis represents a significant evolution in how businesses evaluate the performance of their digital marketing efforts. By providing a more comprehensive view of profitability, it enables FP&A teams to make more informed decisions about resource allocation and strategic planning.

Unit Economics automation platforms like unmess play a crucial role in making PrPC analysis feasible and efficient. By automating the process of cost attribution and providing granular, customer-level insights, unmess enables businesses to implement sophisticated profitability analysis without getting bogged down in complex data integration and calculation processes.

As digital marketing continues to evolve, the ability to accurately measure and optimize profitability at a granular level will become increasingly important. Profit Per Click analysis, supported by advanced tools like unmess, provides a framework for achieving this goal, ultimately leading to more effective marketing strategies and improved financial performance.

Clicks, impressions, conversions - these metrics form the backbone of digital marketing analytics. However, for FP&A teams, these metrics often fall short in providing a complete picture of marketing's impact on the bottom line. That's where PrPC (Profit Per Click) analysis comes in, bridging the gap between marketing metrics and financial outcomes.

Understanding Profit Per Click

Profit Per Click is not to be confused with Pay Per Click, a common digital advertising model. Instead, PrPC in this context refers to the actual profit generated from each click in a digital marketing campaign. This metric goes beyond traditional ROI calculations by factoring in not just revenue, but also the costs associated with each click and subsequent customer actions.

The formula for Profit Per Click is relatively straightforward:

Profit Per Click = (Revenue Per Click - Cost Per Click - Associated Costs Per Click) / Number of Clicks

This metric offers a deeper insight into campaign profitability by requiring marketers and financial analysts to consider all associated costs, not just the direct advertising spend.

Incorporating PrPC analysis into financial assessments ensures that marketing efforts are evaluated with a comprehensive understanding of their financial impact. This holistic approach helps to align marketing strategies with overall business goals, making it easier to optimize campaigns for true profitability.

Why Traditional ROI Falls Short

Traditional ROI calculations for digital marketing often focus on the direct relationship between ad spend and revenue generated. While this provides a basic understanding of campaign performance, it fails to account for several crucial factors:

Customer Acquisition Costs: Beyond the immediate cost of the click, there are often additional costs involved in converting a prospect into a customer.

Customer Lifetime Value: A campaign might have a low immediate ROI but lead to customers with high lifetime value.

Operational Costs: The costs of fulfilling orders, providing customer support, and other operational expenses are often overlooked in traditional ROI calculations.

Opportunity Costs: Resources allocated to one campaign could potentially have been used elsewhere, a factor not captured in simple ROI metrics.

Integrating customer-focused metrics into financial analysis can significantly enhance ROI by providing a more comprehensive view of profitability. These metrics offer valuable insights into the broader impact of customer acquisition and lifetime value on financial planning. For a deeper dive into this approach, explore our blog on Integrating Customer Metrics in Financial Reporting.

Implementing Profit Per Click Analysis

Implementing a Profit Per Click analysis requires collaboration between marketing, finance, and operations teams. Here's a step-by-step guide to getting started:

Data Integration: The first step is to integrate data from various sources, including marketing data (clicks, impressions, conversions), financial data (revenue, costs), and operational data (such as software licensing, customer support expenses, or cloud service costs).

Cost Attribution: Assigning costs to each stage of the customer journey—from the initial click to post-purchase support—requires a nuanced approach. This can be done using two primary methods:

Activity-Based Costing: This approach allocates costs based on specific activities that contribute to the customer journey. It considers the resources consumed at each stage, such as marketing efforts, customer engagement, and support activities. This method provides a more granular view of where costs are incurred.

Unit-Based Costing: In this method, costs are attributed based on the units of output, such as the number of clicks, conversions, or orders fulfilled. It's a more straightforward approach, offering clarity on the cost per unit at different stages of the journey.

Revenue Attribution: Determine how revenue is attributed to specific marketing actions. This might involve multi-touch attribution models to account for complex customer journeys.

Lifetime Value Calculation: Incorporate customer lifetime value into your calculations to account for long-term profitability.

Analysis and Reporting: Develop reports that clearly communicate Profit Per Click metrics, allowing for easy comparison across campaigns and channels.

FP&A teams can significantly boost the effectiveness of PrPC analysis by aligning it with product-led growth strategies. When financial planning is integrated with UX data, businesses can identify key touchpoints that drive the most profit, ultimately leading to better decision-making. You can explore this approach further in The CFO's Playbook for Product-Led Growth: Integrating Finance with UX.

Benefits of Profit Per Click for FP&A

For FP&A teams, Profit Per Click analysis offers several key benefits:

Improved Resource Allocation: By understanding the true profitability of different marketing channels and campaigns, FP&A teams can make more informed decisions about budget allocation.

Enhanced Forecasting: PrPC analysis provides a more accurate picture of the relationship between marketing spend and profitability, enabling more precise financial forecasting.

Better Alignment with Marketing: This approach bridges the gap between marketing metrics and financial outcomes, fostering better collaboration between marketing and finance teams.

Identification of Hidden Costs: The process of implementing PrPC analysis often reveals hidden costs in the customer acquisition and retention process, providing opportunities for optimization.

Long-term Strategic Planning: By incorporating customer lifetime value, PrPC analysis supports long-term strategic planning, aligning marketing efforts with overall business goals.

Challenges and Considerations

While Profit Per Click analysis offers significant benefits, it's not without challenges. Some key considerations include:

Data Quality: The accuracy of PrPC analysis is only as good as the data it's based on. Ensuring data quality across all integrated systems is crucial.

Attribution Complexity: In multi-channel marketing environments, accurately attributing profit to specific clicks can be complex.

Time Lag: There may be a significant time lag between a click and the realization of profit, particularly when considering customer lifetime value.

Implementation Costs: Setting up the systems and processes for PrPC analysis can require significant upfront investment.

Despite these challenges, the insights gained from Profit Per Click analysis can be transformative for businesses seeking to optimize their digital marketing efforts.

Conclusion

Profit Per Click analysis represents a significant evolution in how businesses evaluate the performance of their digital marketing efforts. By providing a more comprehensive view of profitability, it enables FP&A teams to make more informed decisions about resource allocation and strategic planning.

Unit Economics automation platforms like unmess play a crucial role in making PrPC analysis feasible and efficient. By automating the process of cost attribution and providing granular, customer-level insights, unmess enables businesses to implement sophisticated profitability analysis without getting bogged down in complex data integration and calculation processes.

As digital marketing continues to evolve, the ability to accurately measure and optimize profitability at a granular level will become increasingly important. Profit Per Click analysis, supported by advanced tools like unmess, provides a framework for achieving this goal, ultimately leading to more effective marketing strategies and improved financial performance.

Clicks, impressions, conversions - these metrics form the backbone of digital marketing analytics. However, for FP&A teams, these metrics often fall short in providing a complete picture of marketing's impact on the bottom line. That's where PrPC (Profit Per Click) analysis comes in, bridging the gap between marketing metrics and financial outcomes.

Understanding Profit Per Click

Profit Per Click is not to be confused with Pay Per Click, a common digital advertising model. Instead, PrPC in this context refers to the actual profit generated from each click in a digital marketing campaign. This metric goes beyond traditional ROI calculations by factoring in not just revenue, but also the costs associated with each click and subsequent customer actions.

The formula for Profit Per Click is relatively straightforward:

Profit Per Click = (Revenue Per Click - Cost Per Click - Associated Costs Per Click) / Number of Clicks

This metric offers a deeper insight into campaign profitability by requiring marketers and financial analysts to consider all associated costs, not just the direct advertising spend.

Incorporating PrPC analysis into financial assessments ensures that marketing efforts are evaluated with a comprehensive understanding of their financial impact. This holistic approach helps to align marketing strategies with overall business goals, making it easier to optimize campaigns for true profitability.

Why Traditional ROI Falls Short

Traditional ROI calculations for digital marketing often focus on the direct relationship between ad spend and revenue generated. While this provides a basic understanding of campaign performance, it fails to account for several crucial factors:

Customer Acquisition Costs: Beyond the immediate cost of the click, there are often additional costs involved in converting a prospect into a customer.

Customer Lifetime Value: A campaign might have a low immediate ROI but lead to customers with high lifetime value.

Operational Costs: The costs of fulfilling orders, providing customer support, and other operational expenses are often overlooked in traditional ROI calculations.

Opportunity Costs: Resources allocated to one campaign could potentially have been used elsewhere, a factor not captured in simple ROI metrics.

Integrating customer-focused metrics into financial analysis can significantly enhance ROI by providing a more comprehensive view of profitability. These metrics offer valuable insights into the broader impact of customer acquisition and lifetime value on financial planning. For a deeper dive into this approach, explore our blog on Integrating Customer Metrics in Financial Reporting.

Implementing Profit Per Click Analysis

Implementing a Profit Per Click analysis requires collaboration between marketing, finance, and operations teams. Here's a step-by-step guide to getting started:

Data Integration: The first step is to integrate data from various sources, including marketing data (clicks, impressions, conversions), financial data (revenue, costs), and operational data (such as software licensing, customer support expenses, or cloud service costs).

Cost Attribution: Assigning costs to each stage of the customer journey—from the initial click to post-purchase support—requires a nuanced approach. This can be done using two primary methods:

Activity-Based Costing: This approach allocates costs based on specific activities that contribute to the customer journey. It considers the resources consumed at each stage, such as marketing efforts, customer engagement, and support activities. This method provides a more granular view of where costs are incurred.

Unit-Based Costing: In this method, costs are attributed based on the units of output, such as the number of clicks, conversions, or orders fulfilled. It's a more straightforward approach, offering clarity on the cost per unit at different stages of the journey.

Revenue Attribution: Determine how revenue is attributed to specific marketing actions. This might involve multi-touch attribution models to account for complex customer journeys.

Lifetime Value Calculation: Incorporate customer lifetime value into your calculations to account for long-term profitability.

Analysis and Reporting: Develop reports that clearly communicate Profit Per Click metrics, allowing for easy comparison across campaigns and channels.

FP&A teams can significantly boost the effectiveness of PrPC analysis by aligning it with product-led growth strategies. When financial planning is integrated with UX data, businesses can identify key touchpoints that drive the most profit, ultimately leading to better decision-making. You can explore this approach further in The CFO's Playbook for Product-Led Growth: Integrating Finance with UX.

Benefits of Profit Per Click for FP&A

For FP&A teams, Profit Per Click analysis offers several key benefits:

Improved Resource Allocation: By understanding the true profitability of different marketing channels and campaigns, FP&A teams can make more informed decisions about budget allocation.

Enhanced Forecasting: PrPC analysis provides a more accurate picture of the relationship between marketing spend and profitability, enabling more precise financial forecasting.

Better Alignment with Marketing: This approach bridges the gap between marketing metrics and financial outcomes, fostering better collaboration between marketing and finance teams.

Identification of Hidden Costs: The process of implementing PrPC analysis often reveals hidden costs in the customer acquisition and retention process, providing opportunities for optimization.

Long-term Strategic Planning: By incorporating customer lifetime value, PrPC analysis supports long-term strategic planning, aligning marketing efforts with overall business goals.

Challenges and Considerations

While Profit Per Click analysis offers significant benefits, it's not without challenges. Some key considerations include:

Data Quality: The accuracy of PrPC analysis is only as good as the data it's based on. Ensuring data quality across all integrated systems is crucial.

Attribution Complexity: In multi-channel marketing environments, accurately attributing profit to specific clicks can be complex.

Time Lag: There may be a significant time lag between a click and the realization of profit, particularly when considering customer lifetime value.

Implementation Costs: Setting up the systems and processes for PrPC analysis can require significant upfront investment.

Despite these challenges, the insights gained from Profit Per Click analysis can be transformative for businesses seeking to optimize their digital marketing efforts.

Conclusion

Profit Per Click analysis represents a significant evolution in how businesses evaluate the performance of their digital marketing efforts. By providing a more comprehensive view of profitability, it enables FP&A teams to make more informed decisions about resource allocation and strategic planning.

Unit Economics automation platforms like unmess play a crucial role in making PrPC analysis feasible and efficient. By automating the process of cost attribution and providing granular, customer-level insights, unmess enables businesses to implement sophisticated profitability analysis without getting bogged down in complex data integration and calculation processes.

As digital marketing continues to evolve, the ability to accurately measure and optimize profitability at a granular level will become increasingly important. Profit Per Click analysis, supported by advanced tools like unmess, provides a framework for achieving this goal, ultimately leading to more effective marketing strategies and improved financial performance.