2 Aug 2024

Post

Step-By-Step Guide to the Month-End Close Process [Includes a Checklist]

Step-By-Step Guide to the Month-End Close Process [Includes a Checklist]

Month-end close guide with 12-step checklist. Top companies complete in 4.8 days, median is 6.4 days. 87% of finance professionals work overtime during close. Improves accuracy and efficiency.

The month-end close process is a critical financial procedure that ensures accurate reporting and provides valuable insights into a company's financial health. Despite its importance, many organizations struggle with inefficiencies and errors during this complex task. A survey by FloQast revealed that 87% of accounting and finance professionals work overtime during the month-end close, with 57% working more than 10 extra hours.

This guide will walk you through the essential steps of the month-end close process, offering practical tips and a comprehensive checklist to streamline your workflow.

Understanding the Month-End Close Process

The month-end close process involves reconciling financial transactions, preparing financial statements, and ensuring all accounts are accurately represented for the reporting period. This process is crucial for maintaining financial integrity, complying with regulations, and providing stakeholders with timely and accurate financial information.

A study by the American Productivity and Quality Center (APQC) found that top-performing companies complete their monthly close in just 4.8 days or less, while the median performance is 6.4 days. This disparity highlights the potential for improvement in many organizations' month-end close processes.

Key Steps in the Month-End Close Process

Pre-Close Preparation

Effective month-end close starts well before the end of the month. Preparation is key to a smooth and efficient process. Begin by reviewing the previous month's close to identify any recurring issues or bottlenecks. Create a detailed timeline and assign responsibilities to team members.

Ensure all necessary data is readily available, including bank statements, credit card statements, and outstanding invoices. Implement a cut-off date for transactions to be included in the current month's close. This helps prevent last-minute adjustments that can delay the process.

Revenue Recognition and Accounts Receivable

Start by reconciling all revenue accounts, ensuring that all sales have been properly recorded and matched with the corresponding invoices. Review accounts receivable aging reports to identify any potential collection issues or discrepancies.

According to a report by the Credit Research Foundation, the average days sales outstanding (DSO) across industries is 37 days. Monitoring your company's DSO against this benchmark can provide insights into your revenue recognition and collection processes.

Expense Reconciliation and Accounts Payable

Review all expenses for the month, ensuring they are accurately categorized and recorded. Reconcile accounts payable, matching purchase orders with invoices and payments. Pay special attention to accrued expenses and prepaid items to ensure proper allocation across accounting periods.

A study by APQC found that top-performing companies process 90% or more of their invoices electronically, leading to faster reconciliation and fewer errors. Implementing electronic invoice processing can significantly streamline this step of the month-end close.

Inventory Valuation and Asset Reconciliation

For companies with physical inventory, conduct a thorough count and valuation, reconciling any discrepancies between physical counts and book values. Service-based businesses should review work-in-progress and unbilled services.

Update fixed asset registers, recording new acquisitions, disposals, and depreciation. Regular reconciliation of fixed assets helps identify discrepancies early, prevents errors in financial reporting, and provides a clear picture of asset utilization.

Implementing robust inventory management systems and fixed asset tracking processes can streamline this part of the month-end close. These tools automate much of the reconciliation process, reducing time requirements and minimizing human error. Maintaining accurate, up-to-date records throughout the month simplifies the close process and improves overall financial reporting accuracy.

Financial Statement Preparation and Analysis

Once all accounts have been reconciled, prepare the financial statements, including the income statement, balance sheet, and cash flow statement. Review these statements for any anomalies or unexpected variances from previous periods or budgets.

Conduct a thorough variance analysis to understand the reasons behind significant changes in financial performance. This step is crucial for providing meaningful insights to management and stakeholders.

Review and Approval Process

The final step involves a comprehensive review of all financial statements and supporting documents. This review should be conducted by senior financial staff or executives to ensure accuracy and completeness.

Implement a formal approval process, documenting sign-offs at each stage. This not only ensures accountability but also creates an audit trail for future reference.

Conclusion

As businesses strive for greater efficiency and accuracy in their financial processes, technology plays an increasingly crucial role. Platforms like unmess can significantly streamline the month-end close process by providing real-time cost and profitability attribution at a customer level.

By assigning costs to each customer action and building a granular profit and loss statement, unmess enables finance teams to gain deeper insights into their financial performance. This level of detail can enhance the accuracy of financial reporting, simplify variance analysis, and provide valuable data for strategic decision-making.

Implementing such advanced analytics tools can help organizations move beyond traditional month-end close processes, enabling continuous financial monitoring and more agile business practices. As companies continue to optimize their financial operations, leveraging technology like unmess can be a game-changer in achieving faster, more accurate, and more insightful month-end closes.

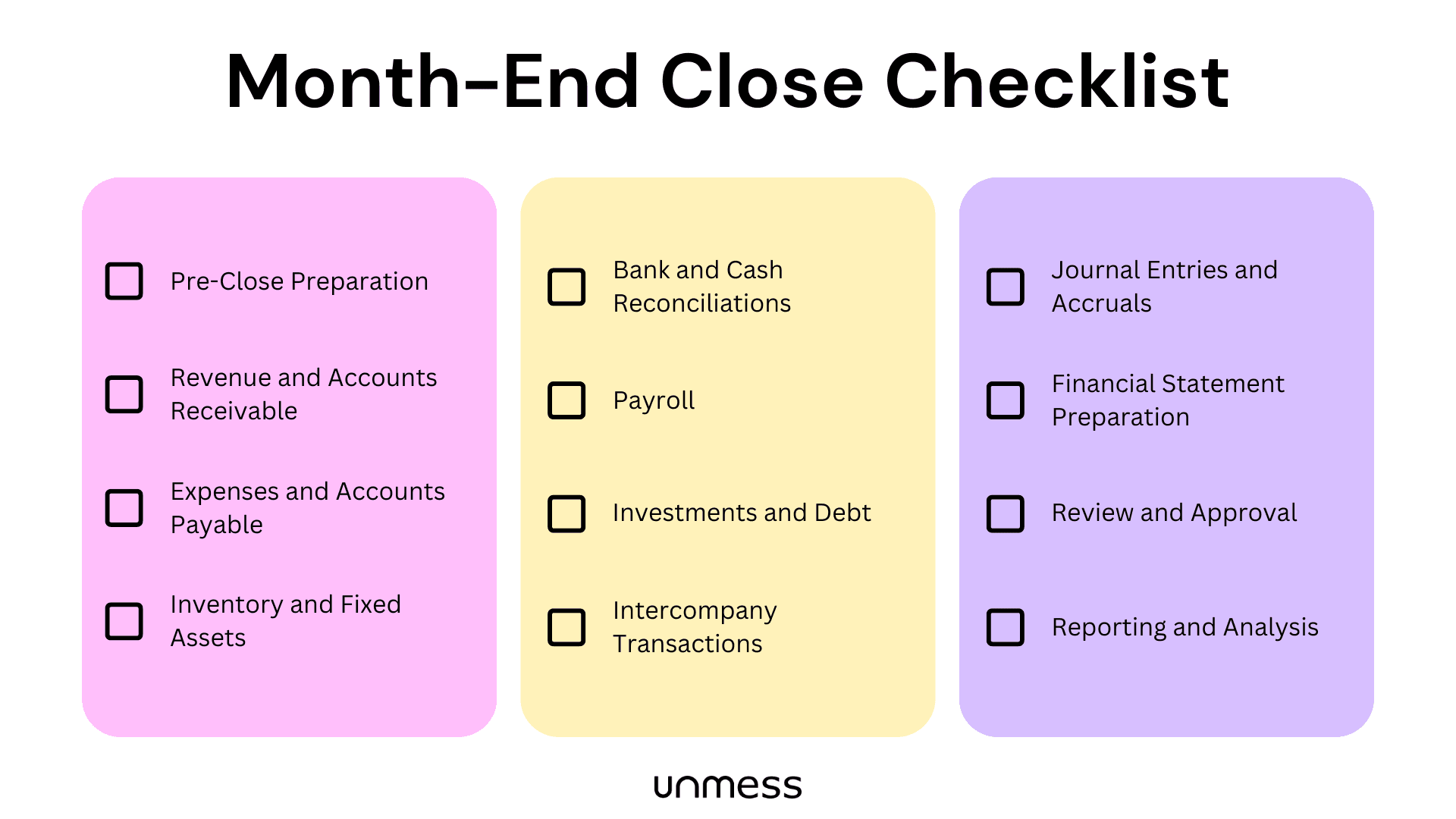

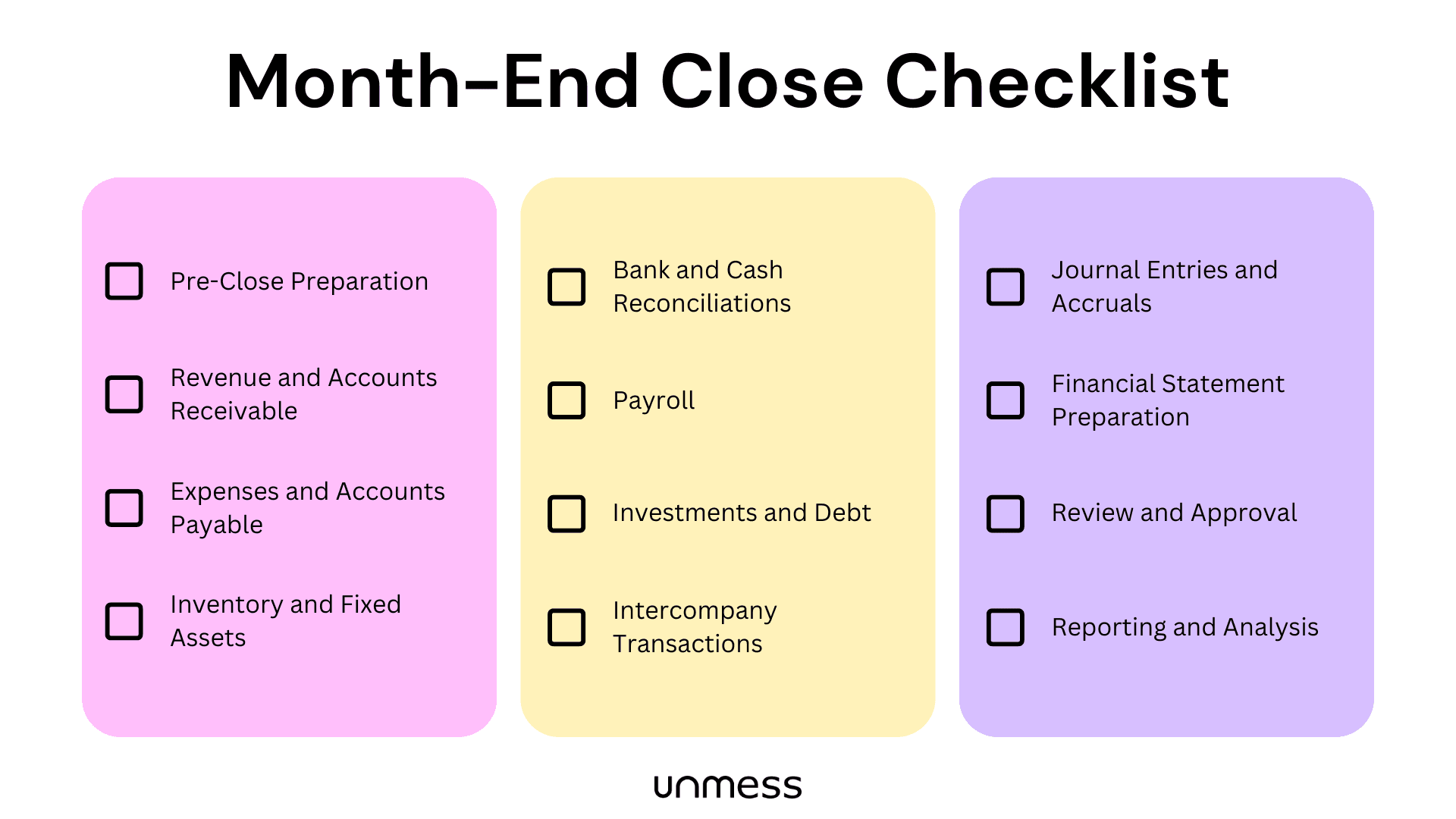

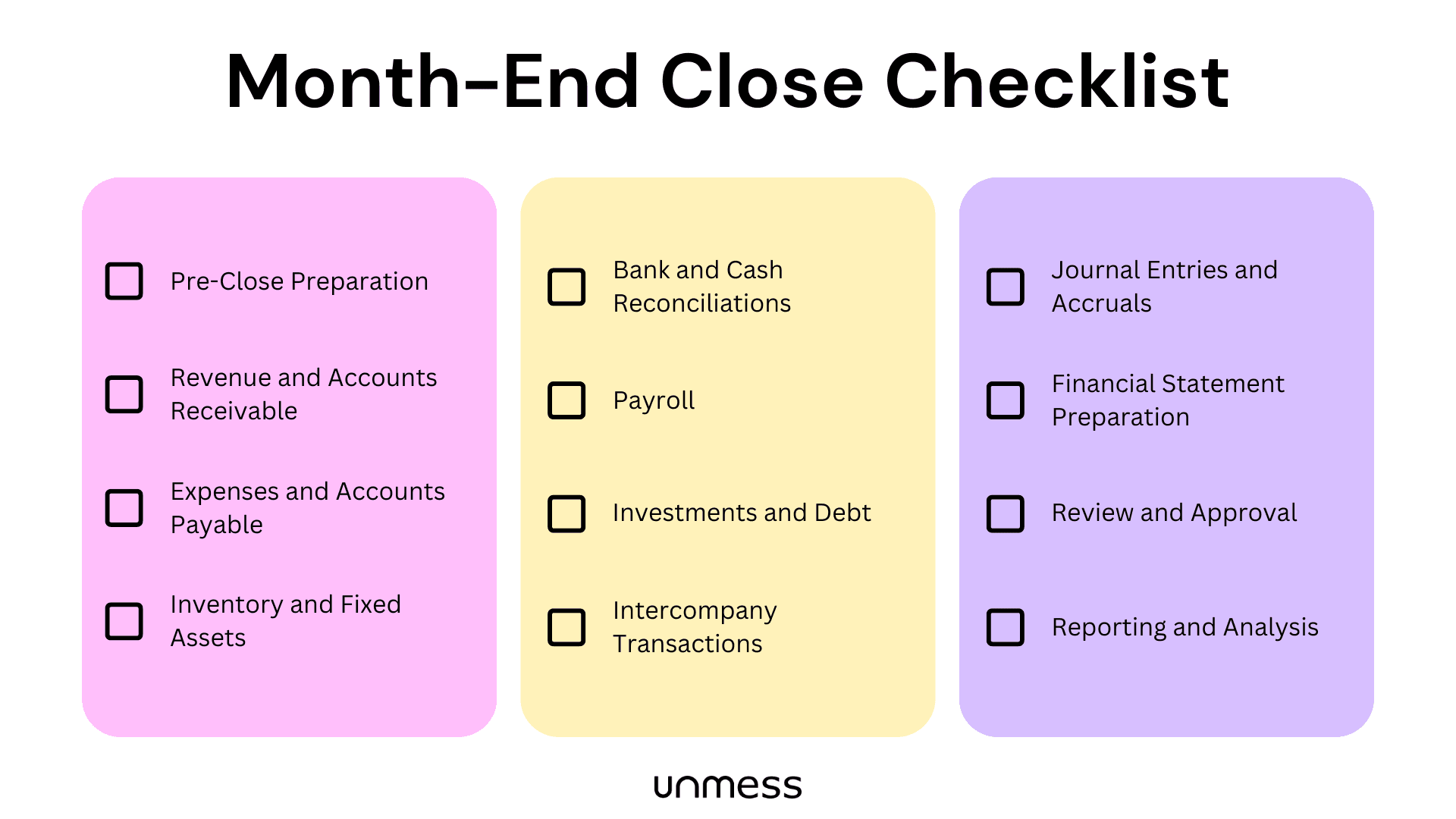

Month-End Close Checklist

A comprehensive checklist is an invaluable tool for ensuring consistency and completeness in your month-end close process. Here's a detailed checklist that covers the key areas:

1. Pre-Close Preparation

Review previous month's close for any outstanding issues

Update close calendar and communicate deadlines to all stakeholders

Ensure all required data sources are accessible

Set cut-off date for transaction processing

2. Revenue and Accounts Receivable

Reconcile all revenue accounts

Review and post all customer invoices

Reconcile accounts receivable subledger to general ledger

Analyze accounts receivable aging report

Calculate and record any necessary bad debt provisions

3. Expenses and Accounts Payable

Review and post all vendor invoices

Reconcile accounts payable subledger to general ledger

Review expense reports and record accruals for any outstanding items

Calculate and record any prepaid expenses

4. Inventory and Fixed Assets

Conduct physical inventory count (if applicable)

Reconcile inventory subledger to general ledger

Review and post any inventory adjustments or write-offs

Update fixed asset register with new acquisitions and disposals

Calculate and record depreciation

5. Bank and Cash Reconciliations

Reconcile all bank accounts

Review and post any bank fees or interest

Reconcile petty cash accounts

6. Payroll

Reconcile payroll accounts

Review and post any payroll accruals

Ensure all payroll taxes are properly recorded and paid

7. Investments and Debt

Reconcile investment accounts

Calculate and record any investment income or losses

Review loan agreements and record any interest expense

Ensure compliance with debt covenants

8. Intercompany Transactions

Reconcile all intercompany accounts

Ensure all intercompany transactions are properly eliminated in consolidated financials

9. Journal Entries and Accruals

Review and post all recurring journal entries

Calculate and record any required accruals

Review and post any manual journal entries

10. Financial Statement Preparation

Generate trial balance and review for accuracy

Prepare income statement, balance sheet, and cash flow statement

Conduct variance analysis against budget and previous periods

Prepare supporting schedules and reconciliations

11. Review and Approval

Perform analytical review of financial statements

Review all reconciliations and supporting documents

Obtain necessary approvals from senior management

Document and file all close procedures and results

12. Reporting and Analysis

Generate management reports

Prepare financial analysis and commentary

Distribute financial packages to stakeholders

While this checklist provides a comprehensive overview, it should be tailored to your organization's specific needs and accounting practices. Regularly reviewing and updating your month-end close process, including the integration of advanced tools like unmess, can lead to significant improvements in efficiency, accuracy, and financial insights.

The month-end close process is a critical financial procedure that ensures accurate reporting and provides valuable insights into a company's financial health. Despite its importance, many organizations struggle with inefficiencies and errors during this complex task. A survey by FloQast revealed that 87% of accounting and finance professionals work overtime during the month-end close, with 57% working more than 10 extra hours.

This guide will walk you through the essential steps of the month-end close process, offering practical tips and a comprehensive checklist to streamline your workflow.

Understanding the Month-End Close Process

The month-end close process involves reconciling financial transactions, preparing financial statements, and ensuring all accounts are accurately represented for the reporting period. This process is crucial for maintaining financial integrity, complying with regulations, and providing stakeholders with timely and accurate financial information.

A study by the American Productivity and Quality Center (APQC) found that top-performing companies complete their monthly close in just 4.8 days or less, while the median performance is 6.4 days. This disparity highlights the potential for improvement in many organizations' month-end close processes.

Key Steps in the Month-End Close Process

Pre-Close Preparation

Effective month-end close starts well before the end of the month. Preparation is key to a smooth and efficient process. Begin by reviewing the previous month's close to identify any recurring issues or bottlenecks. Create a detailed timeline and assign responsibilities to team members.

Ensure all necessary data is readily available, including bank statements, credit card statements, and outstanding invoices. Implement a cut-off date for transactions to be included in the current month's close. This helps prevent last-minute adjustments that can delay the process.

Revenue Recognition and Accounts Receivable

Start by reconciling all revenue accounts, ensuring that all sales have been properly recorded and matched with the corresponding invoices. Review accounts receivable aging reports to identify any potential collection issues or discrepancies.

According to a report by the Credit Research Foundation, the average days sales outstanding (DSO) across industries is 37 days. Monitoring your company's DSO against this benchmark can provide insights into your revenue recognition and collection processes.

Expense Reconciliation and Accounts Payable

Review all expenses for the month, ensuring they are accurately categorized and recorded. Reconcile accounts payable, matching purchase orders with invoices and payments. Pay special attention to accrued expenses and prepaid items to ensure proper allocation across accounting periods.

A study by APQC found that top-performing companies process 90% or more of their invoices electronically, leading to faster reconciliation and fewer errors. Implementing electronic invoice processing can significantly streamline this step of the month-end close.

Inventory Valuation and Asset Reconciliation

For companies with physical inventory, conduct a thorough count and valuation, reconciling any discrepancies between physical counts and book values. Service-based businesses should review work-in-progress and unbilled services.

Update fixed asset registers, recording new acquisitions, disposals, and depreciation. Regular reconciliation of fixed assets helps identify discrepancies early, prevents errors in financial reporting, and provides a clear picture of asset utilization.

Implementing robust inventory management systems and fixed asset tracking processes can streamline this part of the month-end close. These tools automate much of the reconciliation process, reducing time requirements and minimizing human error. Maintaining accurate, up-to-date records throughout the month simplifies the close process and improves overall financial reporting accuracy.

Financial Statement Preparation and Analysis

Once all accounts have been reconciled, prepare the financial statements, including the income statement, balance sheet, and cash flow statement. Review these statements for any anomalies or unexpected variances from previous periods or budgets.

Conduct a thorough variance analysis to understand the reasons behind significant changes in financial performance. This step is crucial for providing meaningful insights to management and stakeholders.

Review and Approval Process

The final step involves a comprehensive review of all financial statements and supporting documents. This review should be conducted by senior financial staff or executives to ensure accuracy and completeness.

Implement a formal approval process, documenting sign-offs at each stage. This not only ensures accountability but also creates an audit trail for future reference.

Conclusion

As businesses strive for greater efficiency and accuracy in their financial processes, technology plays an increasingly crucial role. Platforms like unmess can significantly streamline the month-end close process by providing real-time cost and profitability attribution at a customer level.

By assigning costs to each customer action and building a granular profit and loss statement, unmess enables finance teams to gain deeper insights into their financial performance. This level of detail can enhance the accuracy of financial reporting, simplify variance analysis, and provide valuable data for strategic decision-making.

Implementing such advanced analytics tools can help organizations move beyond traditional month-end close processes, enabling continuous financial monitoring and more agile business practices. As companies continue to optimize their financial operations, leveraging technology like unmess can be a game-changer in achieving faster, more accurate, and more insightful month-end closes.

Month-End Close Checklist

A comprehensive checklist is an invaluable tool for ensuring consistency and completeness in your month-end close process. Here's a detailed checklist that covers the key areas:

1. Pre-Close Preparation

Review previous month's close for any outstanding issues

Update close calendar and communicate deadlines to all stakeholders

Ensure all required data sources are accessible

Set cut-off date for transaction processing

2. Revenue and Accounts Receivable

Reconcile all revenue accounts

Review and post all customer invoices

Reconcile accounts receivable subledger to general ledger

Analyze accounts receivable aging report

Calculate and record any necessary bad debt provisions

3. Expenses and Accounts Payable

Review and post all vendor invoices

Reconcile accounts payable subledger to general ledger

Review expense reports and record accruals for any outstanding items

Calculate and record any prepaid expenses

4. Inventory and Fixed Assets

Conduct physical inventory count (if applicable)

Reconcile inventory subledger to general ledger

Review and post any inventory adjustments or write-offs

Update fixed asset register with new acquisitions and disposals

Calculate and record depreciation

5. Bank and Cash Reconciliations

Reconcile all bank accounts

Review and post any bank fees or interest

Reconcile petty cash accounts

6. Payroll

Reconcile payroll accounts

Review and post any payroll accruals

Ensure all payroll taxes are properly recorded and paid

7. Investments and Debt

Reconcile investment accounts

Calculate and record any investment income or losses

Review loan agreements and record any interest expense

Ensure compliance with debt covenants

8. Intercompany Transactions

Reconcile all intercompany accounts

Ensure all intercompany transactions are properly eliminated in consolidated financials

9. Journal Entries and Accruals

Review and post all recurring journal entries

Calculate and record any required accruals

Review and post any manual journal entries

10. Financial Statement Preparation

Generate trial balance and review for accuracy

Prepare income statement, balance sheet, and cash flow statement

Conduct variance analysis against budget and previous periods

Prepare supporting schedules and reconciliations

11. Review and Approval

Perform analytical review of financial statements

Review all reconciliations and supporting documents

Obtain necessary approvals from senior management

Document and file all close procedures and results

12. Reporting and Analysis

Generate management reports

Prepare financial analysis and commentary

Distribute financial packages to stakeholders

While this checklist provides a comprehensive overview, it should be tailored to your organization's specific needs and accounting practices. Regularly reviewing and updating your month-end close process, including the integration of advanced tools like unmess, can lead to significant improvements in efficiency, accuracy, and financial insights.

The month-end close process is a critical financial procedure that ensures accurate reporting and provides valuable insights into a company's financial health. Despite its importance, many organizations struggle with inefficiencies and errors during this complex task. A survey by FloQast revealed that 87% of accounting and finance professionals work overtime during the month-end close, with 57% working more than 10 extra hours.

This guide will walk you through the essential steps of the month-end close process, offering practical tips and a comprehensive checklist to streamline your workflow.

Understanding the Month-End Close Process

The month-end close process involves reconciling financial transactions, preparing financial statements, and ensuring all accounts are accurately represented for the reporting period. This process is crucial for maintaining financial integrity, complying with regulations, and providing stakeholders with timely and accurate financial information.

A study by the American Productivity and Quality Center (APQC) found that top-performing companies complete their monthly close in just 4.8 days or less, while the median performance is 6.4 days. This disparity highlights the potential for improvement in many organizations' month-end close processes.

Key Steps in the Month-End Close Process

Pre-Close Preparation

Effective month-end close starts well before the end of the month. Preparation is key to a smooth and efficient process. Begin by reviewing the previous month's close to identify any recurring issues or bottlenecks. Create a detailed timeline and assign responsibilities to team members.

Ensure all necessary data is readily available, including bank statements, credit card statements, and outstanding invoices. Implement a cut-off date for transactions to be included in the current month's close. This helps prevent last-minute adjustments that can delay the process.

Revenue Recognition and Accounts Receivable

Start by reconciling all revenue accounts, ensuring that all sales have been properly recorded and matched with the corresponding invoices. Review accounts receivable aging reports to identify any potential collection issues or discrepancies.

According to a report by the Credit Research Foundation, the average days sales outstanding (DSO) across industries is 37 days. Monitoring your company's DSO against this benchmark can provide insights into your revenue recognition and collection processes.

Expense Reconciliation and Accounts Payable

Review all expenses for the month, ensuring they are accurately categorized and recorded. Reconcile accounts payable, matching purchase orders with invoices and payments. Pay special attention to accrued expenses and prepaid items to ensure proper allocation across accounting periods.

A study by APQC found that top-performing companies process 90% or more of their invoices electronically, leading to faster reconciliation and fewer errors. Implementing electronic invoice processing can significantly streamline this step of the month-end close.

Inventory Valuation and Asset Reconciliation

For companies with physical inventory, conduct a thorough count and valuation, reconciling any discrepancies between physical counts and book values. Service-based businesses should review work-in-progress and unbilled services.

Update fixed asset registers, recording new acquisitions, disposals, and depreciation. Regular reconciliation of fixed assets helps identify discrepancies early, prevents errors in financial reporting, and provides a clear picture of asset utilization.

Implementing robust inventory management systems and fixed asset tracking processes can streamline this part of the month-end close. These tools automate much of the reconciliation process, reducing time requirements and minimizing human error. Maintaining accurate, up-to-date records throughout the month simplifies the close process and improves overall financial reporting accuracy.

Financial Statement Preparation and Analysis

Once all accounts have been reconciled, prepare the financial statements, including the income statement, balance sheet, and cash flow statement. Review these statements for any anomalies or unexpected variances from previous periods or budgets.

Conduct a thorough variance analysis to understand the reasons behind significant changes in financial performance. This step is crucial for providing meaningful insights to management and stakeholders.

Review and Approval Process

The final step involves a comprehensive review of all financial statements and supporting documents. This review should be conducted by senior financial staff or executives to ensure accuracy and completeness.

Implement a formal approval process, documenting sign-offs at each stage. This not only ensures accountability but also creates an audit trail for future reference.

Conclusion

As businesses strive for greater efficiency and accuracy in their financial processes, technology plays an increasingly crucial role. Platforms like unmess can significantly streamline the month-end close process by providing real-time cost and profitability attribution at a customer level.

By assigning costs to each customer action and building a granular profit and loss statement, unmess enables finance teams to gain deeper insights into their financial performance. This level of detail can enhance the accuracy of financial reporting, simplify variance analysis, and provide valuable data for strategic decision-making.

Implementing such advanced analytics tools can help organizations move beyond traditional month-end close processes, enabling continuous financial monitoring and more agile business practices. As companies continue to optimize their financial operations, leveraging technology like unmess can be a game-changer in achieving faster, more accurate, and more insightful month-end closes.

Month-End Close Checklist

A comprehensive checklist is an invaluable tool for ensuring consistency and completeness in your month-end close process. Here's a detailed checklist that covers the key areas:

1. Pre-Close Preparation

Review previous month's close for any outstanding issues

Update close calendar and communicate deadlines to all stakeholders

Ensure all required data sources are accessible

Set cut-off date for transaction processing

2. Revenue and Accounts Receivable

Reconcile all revenue accounts

Review and post all customer invoices

Reconcile accounts receivable subledger to general ledger

Analyze accounts receivable aging report

Calculate and record any necessary bad debt provisions

3. Expenses and Accounts Payable

Review and post all vendor invoices

Reconcile accounts payable subledger to general ledger

Review expense reports and record accruals for any outstanding items

Calculate and record any prepaid expenses

4. Inventory and Fixed Assets

Conduct physical inventory count (if applicable)

Reconcile inventory subledger to general ledger

Review and post any inventory adjustments or write-offs

Update fixed asset register with new acquisitions and disposals

Calculate and record depreciation

5. Bank and Cash Reconciliations

Reconcile all bank accounts

Review and post any bank fees or interest

Reconcile petty cash accounts

6. Payroll

Reconcile payroll accounts

Review and post any payroll accruals

Ensure all payroll taxes are properly recorded and paid

7. Investments and Debt

Reconcile investment accounts

Calculate and record any investment income or losses

Review loan agreements and record any interest expense

Ensure compliance with debt covenants

8. Intercompany Transactions

Reconcile all intercompany accounts

Ensure all intercompany transactions are properly eliminated in consolidated financials

9. Journal Entries and Accruals

Review and post all recurring journal entries

Calculate and record any required accruals

Review and post any manual journal entries

10. Financial Statement Preparation

Generate trial balance and review for accuracy

Prepare income statement, balance sheet, and cash flow statement

Conduct variance analysis against budget and previous periods

Prepare supporting schedules and reconciliations

11. Review and Approval

Perform analytical review of financial statements

Review all reconciliations and supporting documents

Obtain necessary approvals from senior management

Document and file all close procedures and results

12. Reporting and Analysis

Generate management reports

Prepare financial analysis and commentary

Distribute financial packages to stakeholders

While this checklist provides a comprehensive overview, it should be tailored to your organization's specific needs and accounting practices. Regularly reviewing and updating your month-end close process, including the integration of advanced tools like unmess, can lead to significant improvements in efficiency, accuracy, and financial insights.