15 Aug 2024

Post

Transforming FP&A to XP&A: A Comprehensive Guide to Modern Financial Planning

Transforming FP&A to XP&A: A Comprehensive Guide to Modern Financial Planning

XP&A extends traditional FP&A by integrating cross-functional data for comprehensive financial planning. It enhances forecasting, strategic decision-making, and organizational agility.

Financial Planning and Analysis (FP&A) has long been a cornerstone of business strategy, providing organizations with the insights needed to make informed financial decisions.

Extended Planning and Analysis (XP&A), also known as Cross Planning and Analysis, a more comprehensive and integrated approach to financial planning that promises to revolutionize how organizations understand and manage their financial health.

XP&A - A Step Beyond FP&A

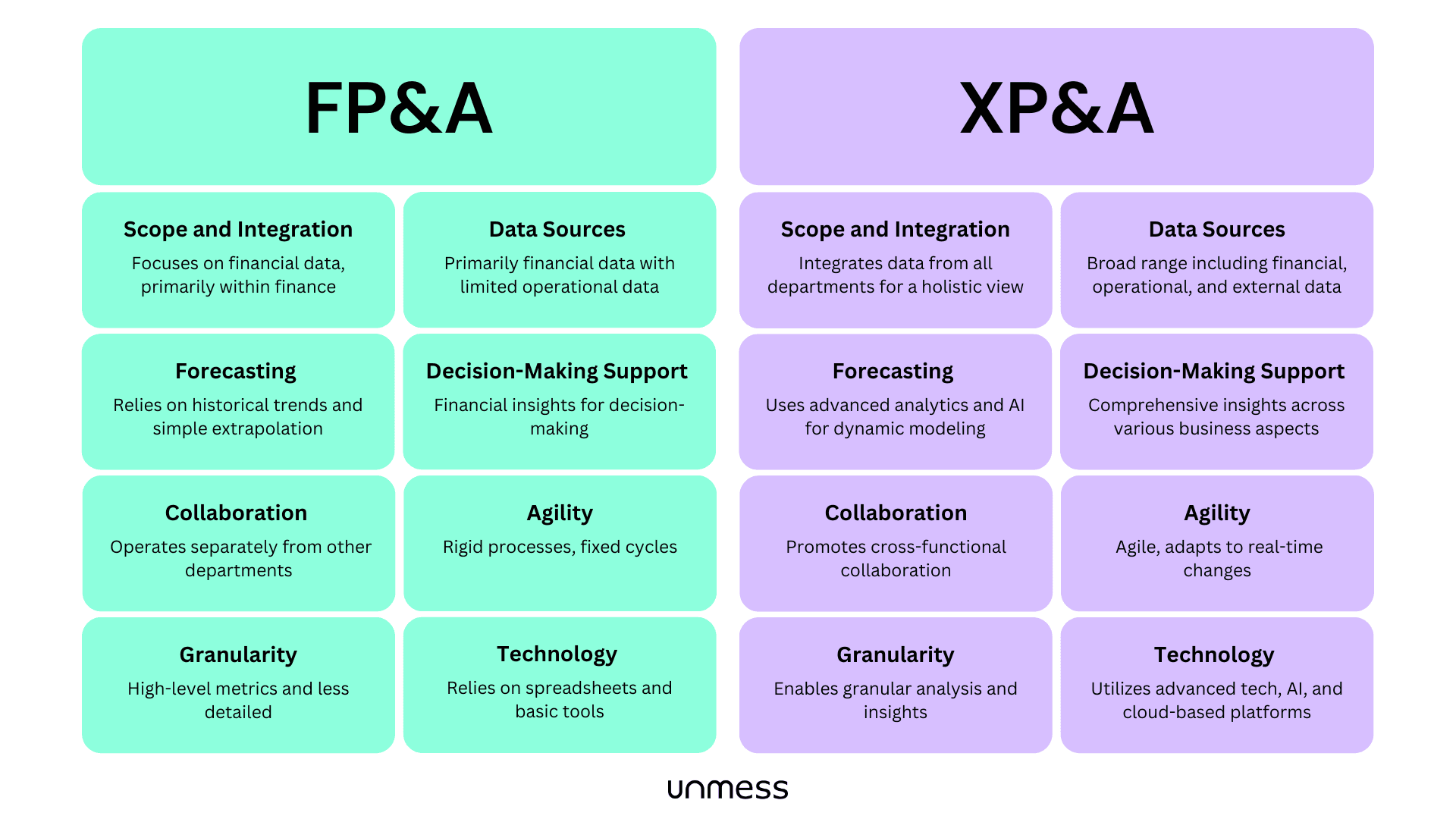

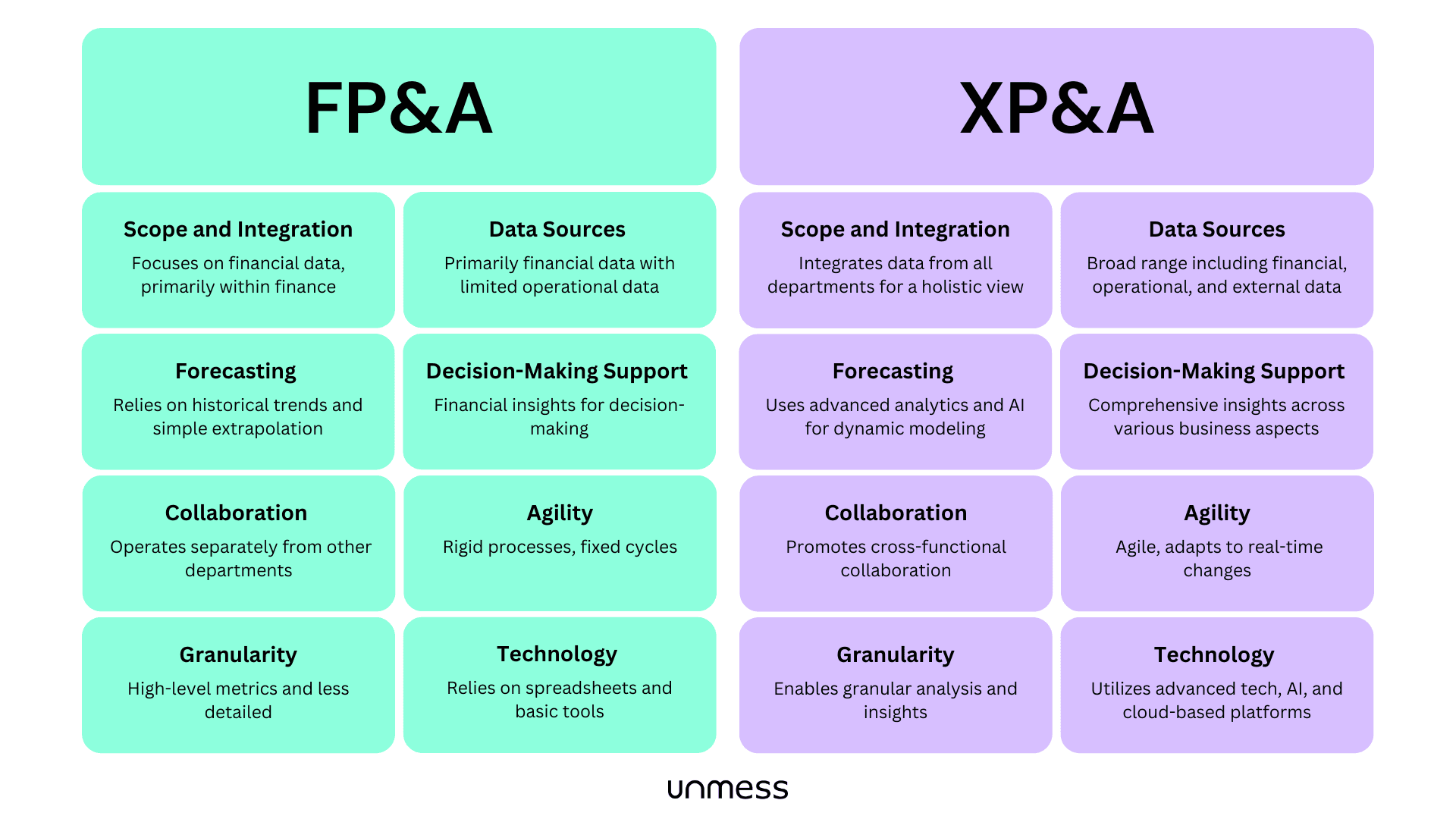

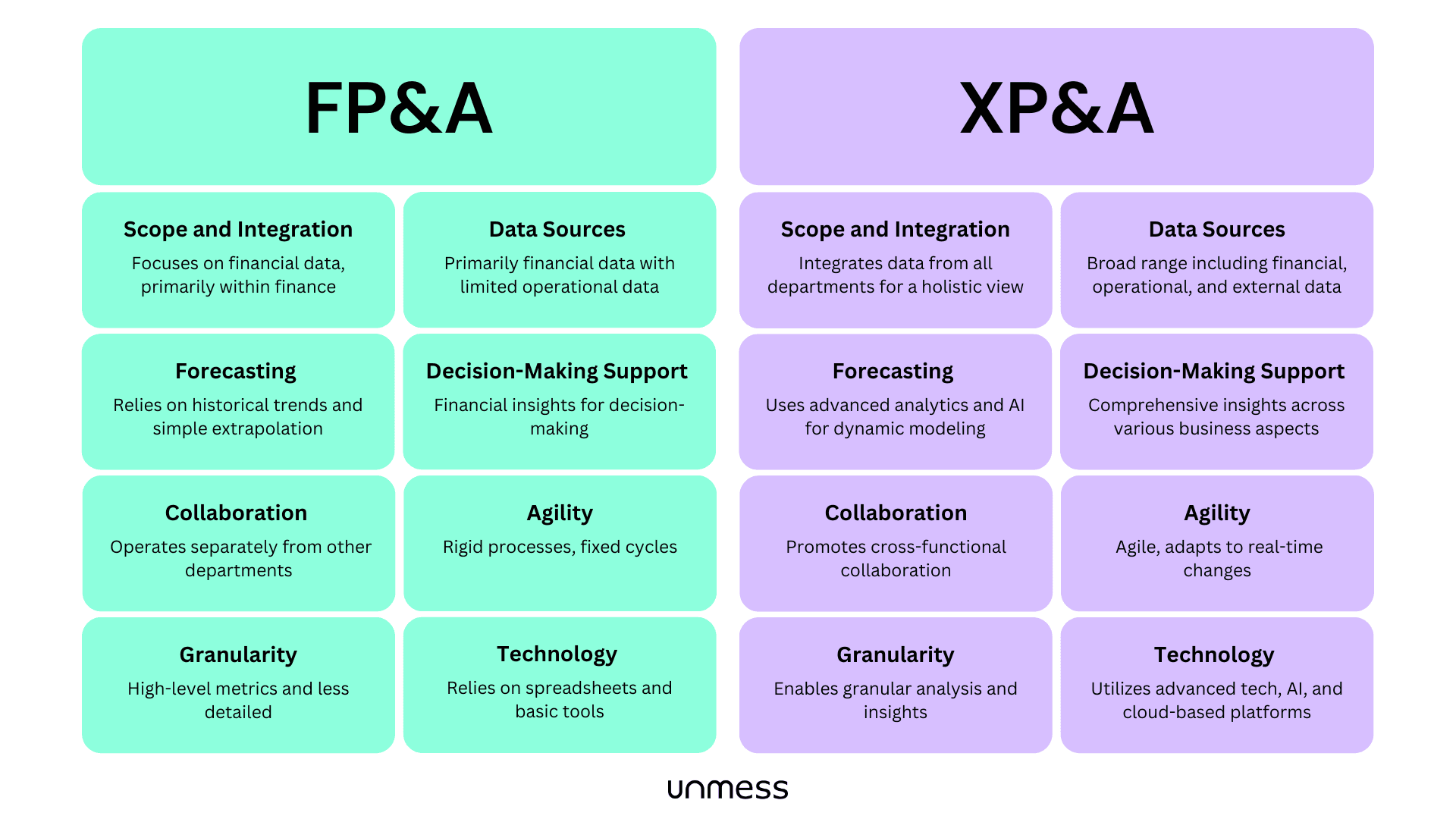

XP&A represents a significant evolution in FP&A. While FP&A primarily focuses on financial data and metrics, XP&A takes a more holistic approach, integrating data and insights from across the entire organization. This broader perspective allows for more accurate forecasting, better resource allocation, and more informed strategic decision-making.

The key difference between XP&A and FP&A lies in their scope and integration level, although both are responsibilities of the finance team. FP&A typically focuses on financial data analysis to guide budgeting and forecasting. XP&A, while still led by finance, expands this approach by breaking down departmental silos and incorporating data from operations, sales, marketing, human resources, and other functions. This broader integration allows XP&A to create a more comprehensive view of the organization's performance and potential.

In 2024, the importance of XP&A has become more pronounced than ever. According to a recent survey by Gartner, 70% of organizations are now investing in technologies and practices that support XP&A. This shift is driven by the need for greater agility and accuracy in financial planning, especially in the face of rapid market changes and increased competition. XP&A enables organizations to respond more quickly to market shifts, identify new opportunities, and mitigate risks more effectively than traditional FP&A approaches.

For a more detailed exploration of XP&A's evolution and its impact on modern financial planning, check out our comprehensive guide here.

Cross-functional Collaboration

One of the most significant benefits of XP&A is its ability to foster cross-functional collaboration within an organization. By breaking down silos between departments and integrating data from various sources, XP&A creates a shared understanding of the company's financial health and strategic objectives across all levels of the organization.

For example, when sales forecasts are integrated with production planning and financial projections, organizations can better manage inventory levels, optimize cash flow, and improve overall operational efficiency. A study by Deloitte found that companies with strong cross-functional collaboration have better adaptability, innovation, and responsiveness, leading to lower operating costs and higher profitability.

Cross-functional collaboration leads to more accurate forecasting, as insights from different departments provide a more complete picture of the organization's performance and potential. It also enables faster decision-making, as all relevant data is readily available and shared across departments. Plus, it promotes a culture of shared responsibility for financial outcomes, increasing accountability and driving better performance across the organization.

Enhanced Cost Modeling and Forecasting

XP&A enhances cost modeling and forecasting capabilities by incorporating a wider range of data points and considering the complex interrelationships between different cost drivers. While traditional FP&A provides valuable insights through analysis of financial data, trend analysis, and sophisticated modeling techniques, XP&A builds upon this foundation by integrating real-time operational data, market insights, and cross-functional information from across the organization. This expanded approach allows XP&A to create even more dynamic and comprehensive cost models, complementing and extending the robust financial analysis provided by FP&A.

This enhanced approach to cost modeling allows organizations to gain a deeper understanding of their cost structures and how they relate to various business activities.

XP&A's advanced capabilities in revealing cost drivers stem from its holistic, cross-functional approach to data analysis. While FP&A provides crucial financial insights, XP&A expands this view by:

Multi-dimensional analysis: XP&A can simultaneously analyze data from finance, operations, marketing, sales, and other departments, uncovering complex interdependencies. For example, it might reveal how:

Changes in product mix affect not just revenue, but also production efficiency, inventory costs, and customer retention rates.

Employee satisfaction metrics correlate with productivity, customer satisfaction, and ultimately, profitability.

Supplier performance impacts not only direct costs, but also production schedules, quality metrics, and customer satisfaction.

Predictive modeling: By integrating diverse data sets, XP&A can build more sophisticated predictive models that account for a wider range of variables. This could include:

Forecasting how macroeconomic factors might impact different business units differently.

Predicting the ripple effects of a price change across various departments and customer segments.

Scenario planning: XP&A enables more comprehensive scenario analysis by:

Simulating the impact of strategic decisions across multiple departments simultaneously.

Identifying potential bottlenecks or risks that might not be apparent when looking at departmental data in isolation.

Real-time adjustments: XP&A's integration of operational data allows for more agile decision-making:

Detecting early warning signs of cost overruns by correlating financial data with operational metrics.

Enabling rapid reallocation of resources based on real-time market data and internal performance metrics.

Root cause analysis: XP&A can dive deeper into the underlying causes of financial trends by:

Tracing financial variances back to specific operational events or market conditions.

Identifying how seemingly unrelated factors in different departments might be contributing to observed financial outcomes.

XP&A also significantly improves forecast accuracy through real-time updates and dynamic planning. According to a report by FSN, organizations using advanced planning and analysis tools (like those employed in XP&A) are 2.5 times more likely to be able to forecast earnings to within ±5%. This improved accuracy is crucial in today's fast-paced business environment, where market conditions can change rapidly.

Real-time forecast updates in XP&A offer tangible benefits:

Rapid response to market shifts:

Example: A retailer can adjust inventory levels within hours of detecting a sudden demand spike, minimizing lost sales opportunities.

Continuous budget realignment:

Instead of annual or quarterly revisions, budgets can be fine-tuned monthly or even weekly, ensuring resources are optimally allocated.

Early warning system:

By continuously comparing actual performance against forecasts, XP&A can flag deviations early, allowing proactive measures.

Scenario-based decision support:

Leaders can quickly model the impact of potential decisions (e.g., a price change) and see cross-functional effects in near real-time.

Improved cash flow management:

Finance teams can more accurately predict short-term cash needs, optimizing working capital.

Enhanced stakeholder communication:

Up-to-date forecasts enable more informed discussions with investors, board members, and other stakeholders.

In volatile industries:

Energy sector: Rapidly adjust production plans based on real-time commodity price fluctuations.

Tech startups: Quickly reallocate resources between projects based on evolving market traction.

Fashion retail: Swiftly modify procurement strategies in response to emerging trends.

This dynamic approach contrasts with traditional methods that might leave organizations operating on outdated assumptions for months between forecast updates.

For more information on how companies can improve their company health, check out our blog post on the best practices for FP&A.

Customer Level Cost Tracking

One area where XP&A truly shines is in customer-level cost tracking and profitability analysis. Traditional FP&A methods often struggle to provide granular insights into customer profitability, typically relying on average costs and revenues across customer segments. XP&A, however, enables a much more detailed analysis by integrating data from various sources across the organization.

The importance of granular customer profitability analysis cannot be overstated. A study found that a 5% increase in customer retention can lead to a 25% to 95% increase in profits. However, to achieve this, organizations need to understand which customers are truly profitable and why.

This level of detail reveals hidden costs and opportunities that might be overlooked in more traditional analyses.

For example, XP&A might reveal that a high-revenue customer is actually unprofitable due to high support costs and frequent API calls. Conversely, it might identify a segment of lower-revenue customers who are highly profitable due to low acquisition costs and minimal support needs. These insights enable organizations to make more informed decisions about customer acquisition, retention strategies, and resource allocation.

Real-time data integration and analysis is a key advantage of XP&A in customer profitability analysis. By continuously updating customer profitability metrics, organizations can quickly identify trends or issues and respond accordingly—whether adjusting pricing, refining service offerings, or reallocating resources to focus on the most profitable relationships. Similarly, strategic workforce planning benefits from real-time data, enabling better alignment of talent with financial goals, optimizing labor costs, and enhancing overall FP&A effectiveness. For more insights, explore our post on Strategic Workforce Planning for FP&A.

Strategic Workforce Planning with XP&A

XP&A revolutionizes strategic workforce planning by integrating it seamlessly into the broader financial and operational planning process. This holistic approach allows organizations to align their human capital strategies more precisely with business objectives.

Multi-dimensional workforce analysis:

Skills inventory mapping: XP&A can correlate skills data with project pipelines, identifying potential skill gaps months in advance.

Productivity optimization: By analyzing productivity metrics alongside financial data, XP&A can pinpoint the optimal staffing levels for maximum efficiency and profitability.

Cost-benefit analysis of human capital investments: XP&A can model the long-term financial impact of training programs or hiring strategies across different scenarios.

Predictive modeling for workforce needs:

Demand forecasting: Integrating sales projections, market trends, and operational data to predict future workforce requirements.

Attrition modeling: Using historical data and external market factors to forecast employee turnover and plan proactive retention strategies.

Scenario planning for workforce strategies:

M&A impact analysis: Modeling how potential mergers or acquisitions would affect workforce composition, costs, and capabilities.

Automation impact assessment: Projecting how introducing new technologies might shift workforce needs and identifying areas for reskilling.

Real-time workforce optimization:

Dynamic resource allocation: Adjusting staffing levels across departments or projects based on real-time performance data and changing priorities.

Gig economy integration: Modeling the optimal mix of full-time employees and contingent workers based on fluctuating demand and skill requirements.

Comprehensive impact analysis:

Cross-functional ripple effects: Assessing how changes in one department's workforce affect other areas, such as how sales team expansion impacts operations and customer service needs.

Total cost of workforce: Going beyond salaries to include benefits, training costs, productivity metrics, and even the costs of unfilled positions or skills gaps.

Strategic capability building:

Future skills forecasting: Analyzing industry trends and company strategy to identify emerging skill requirements and develop targeted upskilling programs.

Succession planning: Integrating performance data, skills assessments, and strategic goals to build robust leadership pipelines.

Compliance and risk management:

Regulatory impact modeling: Assessing how changes in labor laws or industry regulations might affect workforce composition and costs.

Diversity and inclusion planning: Using data to set and track progress towards D&I goals, and model the business impact of a more diverse workforce.

Global workforce optimization:

Geo-location analysis: Modeling the financial and operational impacts of different global staffing strategies, considering factors like labor costs, skills availability, and time zone coverage.

Currency fluctuation impact: Assessing how exchange rate changes might affect the cost-effectiveness of different global workforce configurations.

Employee experience and retention:

Engagement impact analysis: Correlating employee engagement metrics with productivity, customer satisfaction, and financial performance to justify investments in employee experience initiatives.

Retention risk modeling: Identifying high-value employees at risk of leaving and calculating the potential cost of their departure to inform targeted retention strategies.

By leveraging XP&A for strategic workforce planning, organizations can move beyond reactive hiring and cost management to proactively shape their workforce in alignment with long-term business strategy. This approach enables companies to build agile, skilled teams capable of driving innovation and adapting to rapidly changing market conditions.

Conclusion

The transformation from FP&A to XP&A represents a significant leap forward in financial planning and analysis. By breaking down silos, integrating cross-functional data, and enabling more granular analysis, XP&A provides organizations with the tools they need to navigate an increasingly complex business landscape.

While the benefits of XP&A are clear, implementing this approach can be challenging, particularly when it comes to integrating data from various sources and ensuring its accuracy and timeliness. This is where solutions like unmess can play a crucial role.

unmess, as a cost and profitability attribution platform, aligns perfectly with the principles of XP&A. By calculating unit costs at a customer level and assigning costs to each customer action, unmess provides the granular, real-time data that is essential for effective XP&A. This level of detail enables more accurate cost modeling, improved forecasting, and deeper insights into customer profitability.

By leveraging unmess in their XP&A processes, organizations can build a more comprehensive and accurate picture of their financial health, identify hidden costs and opportunities, and make more informed strategic decisions. As businesses continue to navigate an increasingly complex and competitive landscape, the combination of XP&A principles and powerful tools like unmess will be key to driving sustainable growth and profitability.

Financial Planning and Analysis (FP&A) has long been a cornerstone of business strategy, providing organizations with the insights needed to make informed financial decisions.

Extended Planning and Analysis (XP&A), also known as Cross Planning and Analysis, a more comprehensive and integrated approach to financial planning that promises to revolutionize how organizations understand and manage their financial health.

XP&A - A Step Beyond FP&A

XP&A represents a significant evolution in FP&A. While FP&A primarily focuses on financial data and metrics, XP&A takes a more holistic approach, integrating data and insights from across the entire organization. This broader perspective allows for more accurate forecasting, better resource allocation, and more informed strategic decision-making.

The key difference between XP&A and FP&A lies in their scope and integration level, although both are responsibilities of the finance team. FP&A typically focuses on financial data analysis to guide budgeting and forecasting. XP&A, while still led by finance, expands this approach by breaking down departmental silos and incorporating data from operations, sales, marketing, human resources, and other functions. This broader integration allows XP&A to create a more comprehensive view of the organization's performance and potential.

In 2024, the importance of XP&A has become more pronounced than ever. According to a recent survey by Gartner, 70% of organizations are now investing in technologies and practices that support XP&A. This shift is driven by the need for greater agility and accuracy in financial planning, especially in the face of rapid market changes and increased competition. XP&A enables organizations to respond more quickly to market shifts, identify new opportunities, and mitigate risks more effectively than traditional FP&A approaches.

For a more detailed exploration of XP&A's evolution and its impact on modern financial planning, check out our comprehensive guide here.

Cross-functional Collaboration

One of the most significant benefits of XP&A is its ability to foster cross-functional collaboration within an organization. By breaking down silos between departments and integrating data from various sources, XP&A creates a shared understanding of the company's financial health and strategic objectives across all levels of the organization.

For example, when sales forecasts are integrated with production planning and financial projections, organizations can better manage inventory levels, optimize cash flow, and improve overall operational efficiency. A study by Deloitte found that companies with strong cross-functional collaboration have better adaptability, innovation, and responsiveness, leading to lower operating costs and higher profitability.

Cross-functional collaboration leads to more accurate forecasting, as insights from different departments provide a more complete picture of the organization's performance and potential. It also enables faster decision-making, as all relevant data is readily available and shared across departments. Plus, it promotes a culture of shared responsibility for financial outcomes, increasing accountability and driving better performance across the organization.

Enhanced Cost Modeling and Forecasting

XP&A enhances cost modeling and forecasting capabilities by incorporating a wider range of data points and considering the complex interrelationships between different cost drivers. While traditional FP&A provides valuable insights through analysis of financial data, trend analysis, and sophisticated modeling techniques, XP&A builds upon this foundation by integrating real-time operational data, market insights, and cross-functional information from across the organization. This expanded approach allows XP&A to create even more dynamic and comprehensive cost models, complementing and extending the robust financial analysis provided by FP&A.

This enhanced approach to cost modeling allows organizations to gain a deeper understanding of their cost structures and how they relate to various business activities.

XP&A's advanced capabilities in revealing cost drivers stem from its holistic, cross-functional approach to data analysis. While FP&A provides crucial financial insights, XP&A expands this view by:

Multi-dimensional analysis: XP&A can simultaneously analyze data from finance, operations, marketing, sales, and other departments, uncovering complex interdependencies. For example, it might reveal how:

Changes in product mix affect not just revenue, but also production efficiency, inventory costs, and customer retention rates.

Employee satisfaction metrics correlate with productivity, customer satisfaction, and ultimately, profitability.

Supplier performance impacts not only direct costs, but also production schedules, quality metrics, and customer satisfaction.

Predictive modeling: By integrating diverse data sets, XP&A can build more sophisticated predictive models that account for a wider range of variables. This could include:

Forecasting how macroeconomic factors might impact different business units differently.

Predicting the ripple effects of a price change across various departments and customer segments.

Scenario planning: XP&A enables more comprehensive scenario analysis by:

Simulating the impact of strategic decisions across multiple departments simultaneously.

Identifying potential bottlenecks or risks that might not be apparent when looking at departmental data in isolation.

Real-time adjustments: XP&A's integration of operational data allows for more agile decision-making:

Detecting early warning signs of cost overruns by correlating financial data with operational metrics.

Enabling rapid reallocation of resources based on real-time market data and internal performance metrics.

Root cause analysis: XP&A can dive deeper into the underlying causes of financial trends by:

Tracing financial variances back to specific operational events or market conditions.

Identifying how seemingly unrelated factors in different departments might be contributing to observed financial outcomes.

XP&A also significantly improves forecast accuracy through real-time updates and dynamic planning. According to a report by FSN, organizations using advanced planning and analysis tools (like those employed in XP&A) are 2.5 times more likely to be able to forecast earnings to within ±5%. This improved accuracy is crucial in today's fast-paced business environment, where market conditions can change rapidly.

Real-time forecast updates in XP&A offer tangible benefits:

Rapid response to market shifts:

Example: A retailer can adjust inventory levels within hours of detecting a sudden demand spike, minimizing lost sales opportunities.

Continuous budget realignment:

Instead of annual or quarterly revisions, budgets can be fine-tuned monthly or even weekly, ensuring resources are optimally allocated.

Early warning system:

By continuously comparing actual performance against forecasts, XP&A can flag deviations early, allowing proactive measures.

Scenario-based decision support:

Leaders can quickly model the impact of potential decisions (e.g., a price change) and see cross-functional effects in near real-time.

Improved cash flow management:

Finance teams can more accurately predict short-term cash needs, optimizing working capital.

Enhanced stakeholder communication:

Up-to-date forecasts enable more informed discussions with investors, board members, and other stakeholders.

In volatile industries:

Energy sector: Rapidly adjust production plans based on real-time commodity price fluctuations.

Tech startups: Quickly reallocate resources between projects based on evolving market traction.

Fashion retail: Swiftly modify procurement strategies in response to emerging trends.

This dynamic approach contrasts with traditional methods that might leave organizations operating on outdated assumptions for months between forecast updates.

For more information on how companies can improve their company health, check out our blog post on the best practices for FP&A.

Customer Level Cost Tracking

One area where XP&A truly shines is in customer-level cost tracking and profitability analysis. Traditional FP&A methods often struggle to provide granular insights into customer profitability, typically relying on average costs and revenues across customer segments. XP&A, however, enables a much more detailed analysis by integrating data from various sources across the organization.

The importance of granular customer profitability analysis cannot be overstated. A study found that a 5% increase in customer retention can lead to a 25% to 95% increase in profits. However, to achieve this, organizations need to understand which customers are truly profitable and why.

This level of detail reveals hidden costs and opportunities that might be overlooked in more traditional analyses.

For example, XP&A might reveal that a high-revenue customer is actually unprofitable due to high support costs and frequent API calls. Conversely, it might identify a segment of lower-revenue customers who are highly profitable due to low acquisition costs and minimal support needs. These insights enable organizations to make more informed decisions about customer acquisition, retention strategies, and resource allocation.

Real-time data integration and analysis is a key advantage of XP&A in customer profitability analysis. By continuously updating customer profitability metrics, organizations can quickly identify trends or issues and respond accordingly—whether adjusting pricing, refining service offerings, or reallocating resources to focus on the most profitable relationships. Similarly, strategic workforce planning benefits from real-time data, enabling better alignment of talent with financial goals, optimizing labor costs, and enhancing overall FP&A effectiveness. For more insights, explore our post on Strategic Workforce Planning for FP&A.

Strategic Workforce Planning with XP&A

XP&A revolutionizes strategic workforce planning by integrating it seamlessly into the broader financial and operational planning process. This holistic approach allows organizations to align their human capital strategies more precisely with business objectives.

Multi-dimensional workforce analysis:

Skills inventory mapping: XP&A can correlate skills data with project pipelines, identifying potential skill gaps months in advance.

Productivity optimization: By analyzing productivity metrics alongside financial data, XP&A can pinpoint the optimal staffing levels for maximum efficiency and profitability.

Cost-benefit analysis of human capital investments: XP&A can model the long-term financial impact of training programs or hiring strategies across different scenarios.

Predictive modeling for workforce needs:

Demand forecasting: Integrating sales projections, market trends, and operational data to predict future workforce requirements.

Attrition modeling: Using historical data and external market factors to forecast employee turnover and plan proactive retention strategies.

Scenario planning for workforce strategies:

M&A impact analysis: Modeling how potential mergers or acquisitions would affect workforce composition, costs, and capabilities.

Automation impact assessment: Projecting how introducing new technologies might shift workforce needs and identifying areas for reskilling.

Real-time workforce optimization:

Dynamic resource allocation: Adjusting staffing levels across departments or projects based on real-time performance data and changing priorities.

Gig economy integration: Modeling the optimal mix of full-time employees and contingent workers based on fluctuating demand and skill requirements.

Comprehensive impact analysis:

Cross-functional ripple effects: Assessing how changes in one department's workforce affect other areas, such as how sales team expansion impacts operations and customer service needs.

Total cost of workforce: Going beyond salaries to include benefits, training costs, productivity metrics, and even the costs of unfilled positions or skills gaps.

Strategic capability building:

Future skills forecasting: Analyzing industry trends and company strategy to identify emerging skill requirements and develop targeted upskilling programs.

Succession planning: Integrating performance data, skills assessments, and strategic goals to build robust leadership pipelines.

Compliance and risk management:

Regulatory impact modeling: Assessing how changes in labor laws or industry regulations might affect workforce composition and costs.

Diversity and inclusion planning: Using data to set and track progress towards D&I goals, and model the business impact of a more diverse workforce.

Global workforce optimization:

Geo-location analysis: Modeling the financial and operational impacts of different global staffing strategies, considering factors like labor costs, skills availability, and time zone coverage.

Currency fluctuation impact: Assessing how exchange rate changes might affect the cost-effectiveness of different global workforce configurations.

Employee experience and retention:

Engagement impact analysis: Correlating employee engagement metrics with productivity, customer satisfaction, and financial performance to justify investments in employee experience initiatives.

Retention risk modeling: Identifying high-value employees at risk of leaving and calculating the potential cost of their departure to inform targeted retention strategies.

By leveraging XP&A for strategic workforce planning, organizations can move beyond reactive hiring and cost management to proactively shape their workforce in alignment with long-term business strategy. This approach enables companies to build agile, skilled teams capable of driving innovation and adapting to rapidly changing market conditions.

Conclusion

The transformation from FP&A to XP&A represents a significant leap forward in financial planning and analysis. By breaking down silos, integrating cross-functional data, and enabling more granular analysis, XP&A provides organizations with the tools they need to navigate an increasingly complex business landscape.

While the benefits of XP&A are clear, implementing this approach can be challenging, particularly when it comes to integrating data from various sources and ensuring its accuracy and timeliness. This is where solutions like unmess can play a crucial role.

unmess, as a cost and profitability attribution platform, aligns perfectly with the principles of XP&A. By calculating unit costs at a customer level and assigning costs to each customer action, unmess provides the granular, real-time data that is essential for effective XP&A. This level of detail enables more accurate cost modeling, improved forecasting, and deeper insights into customer profitability.

By leveraging unmess in their XP&A processes, organizations can build a more comprehensive and accurate picture of their financial health, identify hidden costs and opportunities, and make more informed strategic decisions. As businesses continue to navigate an increasingly complex and competitive landscape, the combination of XP&A principles and powerful tools like unmess will be key to driving sustainable growth and profitability.

Financial Planning and Analysis (FP&A) has long been a cornerstone of business strategy, providing organizations with the insights needed to make informed financial decisions.

Extended Planning and Analysis (XP&A), also known as Cross Planning and Analysis, a more comprehensive and integrated approach to financial planning that promises to revolutionize how organizations understand and manage their financial health.

XP&A - A Step Beyond FP&A

XP&A represents a significant evolution in FP&A. While FP&A primarily focuses on financial data and metrics, XP&A takes a more holistic approach, integrating data and insights from across the entire organization. This broader perspective allows for more accurate forecasting, better resource allocation, and more informed strategic decision-making.

The key difference between XP&A and FP&A lies in their scope and integration level, although both are responsibilities of the finance team. FP&A typically focuses on financial data analysis to guide budgeting and forecasting. XP&A, while still led by finance, expands this approach by breaking down departmental silos and incorporating data from operations, sales, marketing, human resources, and other functions. This broader integration allows XP&A to create a more comprehensive view of the organization's performance and potential.

In 2024, the importance of XP&A has become more pronounced than ever. According to a recent survey by Gartner, 70% of organizations are now investing in technologies and practices that support XP&A. This shift is driven by the need for greater agility and accuracy in financial planning, especially in the face of rapid market changes and increased competition. XP&A enables organizations to respond more quickly to market shifts, identify new opportunities, and mitigate risks more effectively than traditional FP&A approaches.

For a more detailed exploration of XP&A's evolution and its impact on modern financial planning, check out our comprehensive guide here.

Cross-functional Collaboration

One of the most significant benefits of XP&A is its ability to foster cross-functional collaboration within an organization. By breaking down silos between departments and integrating data from various sources, XP&A creates a shared understanding of the company's financial health and strategic objectives across all levels of the organization.

For example, when sales forecasts are integrated with production planning and financial projections, organizations can better manage inventory levels, optimize cash flow, and improve overall operational efficiency. A study by Deloitte found that companies with strong cross-functional collaboration have better adaptability, innovation, and responsiveness, leading to lower operating costs and higher profitability.

Cross-functional collaboration leads to more accurate forecasting, as insights from different departments provide a more complete picture of the organization's performance and potential. It also enables faster decision-making, as all relevant data is readily available and shared across departments. Plus, it promotes a culture of shared responsibility for financial outcomes, increasing accountability and driving better performance across the organization.

Enhanced Cost Modeling and Forecasting

XP&A enhances cost modeling and forecasting capabilities by incorporating a wider range of data points and considering the complex interrelationships between different cost drivers. While traditional FP&A provides valuable insights through analysis of financial data, trend analysis, and sophisticated modeling techniques, XP&A builds upon this foundation by integrating real-time operational data, market insights, and cross-functional information from across the organization. This expanded approach allows XP&A to create even more dynamic and comprehensive cost models, complementing and extending the robust financial analysis provided by FP&A.

This enhanced approach to cost modeling allows organizations to gain a deeper understanding of their cost structures and how they relate to various business activities.

XP&A's advanced capabilities in revealing cost drivers stem from its holistic, cross-functional approach to data analysis. While FP&A provides crucial financial insights, XP&A expands this view by:

Multi-dimensional analysis: XP&A can simultaneously analyze data from finance, operations, marketing, sales, and other departments, uncovering complex interdependencies. For example, it might reveal how:

Changes in product mix affect not just revenue, but also production efficiency, inventory costs, and customer retention rates.

Employee satisfaction metrics correlate with productivity, customer satisfaction, and ultimately, profitability.

Supplier performance impacts not only direct costs, but also production schedules, quality metrics, and customer satisfaction.

Predictive modeling: By integrating diverse data sets, XP&A can build more sophisticated predictive models that account for a wider range of variables. This could include:

Forecasting how macroeconomic factors might impact different business units differently.

Predicting the ripple effects of a price change across various departments and customer segments.

Scenario planning: XP&A enables more comprehensive scenario analysis by:

Simulating the impact of strategic decisions across multiple departments simultaneously.

Identifying potential bottlenecks or risks that might not be apparent when looking at departmental data in isolation.

Real-time adjustments: XP&A's integration of operational data allows for more agile decision-making:

Detecting early warning signs of cost overruns by correlating financial data with operational metrics.

Enabling rapid reallocation of resources based on real-time market data and internal performance metrics.

Root cause analysis: XP&A can dive deeper into the underlying causes of financial trends by:

Tracing financial variances back to specific operational events or market conditions.

Identifying how seemingly unrelated factors in different departments might be contributing to observed financial outcomes.

XP&A also significantly improves forecast accuracy through real-time updates and dynamic planning. According to a report by FSN, organizations using advanced planning and analysis tools (like those employed in XP&A) are 2.5 times more likely to be able to forecast earnings to within ±5%. This improved accuracy is crucial in today's fast-paced business environment, where market conditions can change rapidly.

Real-time forecast updates in XP&A offer tangible benefits:

Rapid response to market shifts:

Example: A retailer can adjust inventory levels within hours of detecting a sudden demand spike, minimizing lost sales opportunities.

Continuous budget realignment:

Instead of annual or quarterly revisions, budgets can be fine-tuned monthly or even weekly, ensuring resources are optimally allocated.

Early warning system:

By continuously comparing actual performance against forecasts, XP&A can flag deviations early, allowing proactive measures.

Scenario-based decision support:

Leaders can quickly model the impact of potential decisions (e.g., a price change) and see cross-functional effects in near real-time.

Improved cash flow management:

Finance teams can more accurately predict short-term cash needs, optimizing working capital.

Enhanced stakeholder communication:

Up-to-date forecasts enable more informed discussions with investors, board members, and other stakeholders.

In volatile industries:

Energy sector: Rapidly adjust production plans based on real-time commodity price fluctuations.

Tech startups: Quickly reallocate resources between projects based on evolving market traction.

Fashion retail: Swiftly modify procurement strategies in response to emerging trends.

This dynamic approach contrasts with traditional methods that might leave organizations operating on outdated assumptions for months between forecast updates.

For more information on how companies can improve their company health, check out our blog post on the best practices for FP&A.

Customer Level Cost Tracking

One area where XP&A truly shines is in customer-level cost tracking and profitability analysis. Traditional FP&A methods often struggle to provide granular insights into customer profitability, typically relying on average costs and revenues across customer segments. XP&A, however, enables a much more detailed analysis by integrating data from various sources across the organization.

The importance of granular customer profitability analysis cannot be overstated. A study found that a 5% increase in customer retention can lead to a 25% to 95% increase in profits. However, to achieve this, organizations need to understand which customers are truly profitable and why.

This level of detail reveals hidden costs and opportunities that might be overlooked in more traditional analyses.

For example, XP&A might reveal that a high-revenue customer is actually unprofitable due to high support costs and frequent API calls. Conversely, it might identify a segment of lower-revenue customers who are highly profitable due to low acquisition costs and minimal support needs. These insights enable organizations to make more informed decisions about customer acquisition, retention strategies, and resource allocation.

Real-time data integration and analysis is a key advantage of XP&A in customer profitability analysis. By continuously updating customer profitability metrics, organizations can quickly identify trends or issues and respond accordingly—whether adjusting pricing, refining service offerings, or reallocating resources to focus on the most profitable relationships. Similarly, strategic workforce planning benefits from real-time data, enabling better alignment of talent with financial goals, optimizing labor costs, and enhancing overall FP&A effectiveness. For more insights, explore our post on Strategic Workforce Planning for FP&A.

Strategic Workforce Planning with XP&A

XP&A revolutionizes strategic workforce planning by integrating it seamlessly into the broader financial and operational planning process. This holistic approach allows organizations to align their human capital strategies more precisely with business objectives.

Multi-dimensional workforce analysis:

Skills inventory mapping: XP&A can correlate skills data with project pipelines, identifying potential skill gaps months in advance.

Productivity optimization: By analyzing productivity metrics alongside financial data, XP&A can pinpoint the optimal staffing levels for maximum efficiency and profitability.

Cost-benefit analysis of human capital investments: XP&A can model the long-term financial impact of training programs or hiring strategies across different scenarios.

Predictive modeling for workforce needs:

Demand forecasting: Integrating sales projections, market trends, and operational data to predict future workforce requirements.

Attrition modeling: Using historical data and external market factors to forecast employee turnover and plan proactive retention strategies.

Scenario planning for workforce strategies:

M&A impact analysis: Modeling how potential mergers or acquisitions would affect workforce composition, costs, and capabilities.

Automation impact assessment: Projecting how introducing new technologies might shift workforce needs and identifying areas for reskilling.

Real-time workforce optimization:

Dynamic resource allocation: Adjusting staffing levels across departments or projects based on real-time performance data and changing priorities.

Gig economy integration: Modeling the optimal mix of full-time employees and contingent workers based on fluctuating demand and skill requirements.

Comprehensive impact analysis:

Cross-functional ripple effects: Assessing how changes in one department's workforce affect other areas, such as how sales team expansion impacts operations and customer service needs.

Total cost of workforce: Going beyond salaries to include benefits, training costs, productivity metrics, and even the costs of unfilled positions or skills gaps.

Strategic capability building:

Future skills forecasting: Analyzing industry trends and company strategy to identify emerging skill requirements and develop targeted upskilling programs.

Succession planning: Integrating performance data, skills assessments, and strategic goals to build robust leadership pipelines.

Compliance and risk management:

Regulatory impact modeling: Assessing how changes in labor laws or industry regulations might affect workforce composition and costs.

Diversity and inclusion planning: Using data to set and track progress towards D&I goals, and model the business impact of a more diverse workforce.

Global workforce optimization:

Geo-location analysis: Modeling the financial and operational impacts of different global staffing strategies, considering factors like labor costs, skills availability, and time zone coverage.

Currency fluctuation impact: Assessing how exchange rate changes might affect the cost-effectiveness of different global workforce configurations.

Employee experience and retention:

Engagement impact analysis: Correlating employee engagement metrics with productivity, customer satisfaction, and financial performance to justify investments in employee experience initiatives.

Retention risk modeling: Identifying high-value employees at risk of leaving and calculating the potential cost of their departure to inform targeted retention strategies.

By leveraging XP&A for strategic workforce planning, organizations can move beyond reactive hiring and cost management to proactively shape their workforce in alignment with long-term business strategy. This approach enables companies to build agile, skilled teams capable of driving innovation and adapting to rapidly changing market conditions.

Conclusion

The transformation from FP&A to XP&A represents a significant leap forward in financial planning and analysis. By breaking down silos, integrating cross-functional data, and enabling more granular analysis, XP&A provides organizations with the tools they need to navigate an increasingly complex business landscape.

While the benefits of XP&A are clear, implementing this approach can be challenging, particularly when it comes to integrating data from various sources and ensuring its accuracy and timeliness. This is where solutions like unmess can play a crucial role.

unmess, as a cost and profitability attribution platform, aligns perfectly with the principles of XP&A. By calculating unit costs at a customer level and assigning costs to each customer action, unmess provides the granular, real-time data that is essential for effective XP&A. This level of detail enables more accurate cost modeling, improved forecasting, and deeper insights into customer profitability.

By leveraging unmess in their XP&A processes, organizations can build a more comprehensive and accurate picture of their financial health, identify hidden costs and opportunities, and make more informed strategic decisions. As businesses continue to navigate an increasingly complex and competitive landscape, the combination of XP&A principles and powerful tools like unmess will be key to driving sustainable growth and profitability.