21 Aug 2024

Post

Using Financial Data to Redefine Market Approaches (Customer Segmentation)

Using Financial Data to Redefine Market Approaches (Customer Segmentation)

Integrating customer and financial data enables nuanced customer segmentation, driving more effective marketing strategies and improved business performance

While traditional financial reporting provides essential insights, it can fall short in capturing the full breadth of a company's performance. By incorporating additional customer data and metrics, businesses can gain a more comprehensive understanding of their operations and financial health.

Customer Metrics for financial analysis

Effective customer segmentation is essential for businesses to target the right audiences, allocate resources efficiently, and drive profitable growth. Traditionally, customer segmentation has been based on demographic, psychographic, or behavioral data. While these approaches provide valuable insights, they don't necessarily reveal the true drivers of customer value and profitability.

By incorporating financial data into the segmentation process, businesses can uncover profitability patterns and develop more accurate customer personas. This data-driven approach allows companies to identify their most valuable customer segments, understand the characteristics that make them profitable, and tailor their strategies accordingly. In fact, understanding these profitability patterns is key, as discussed in our article on “A Deep Dive into Customer Segmentation”.

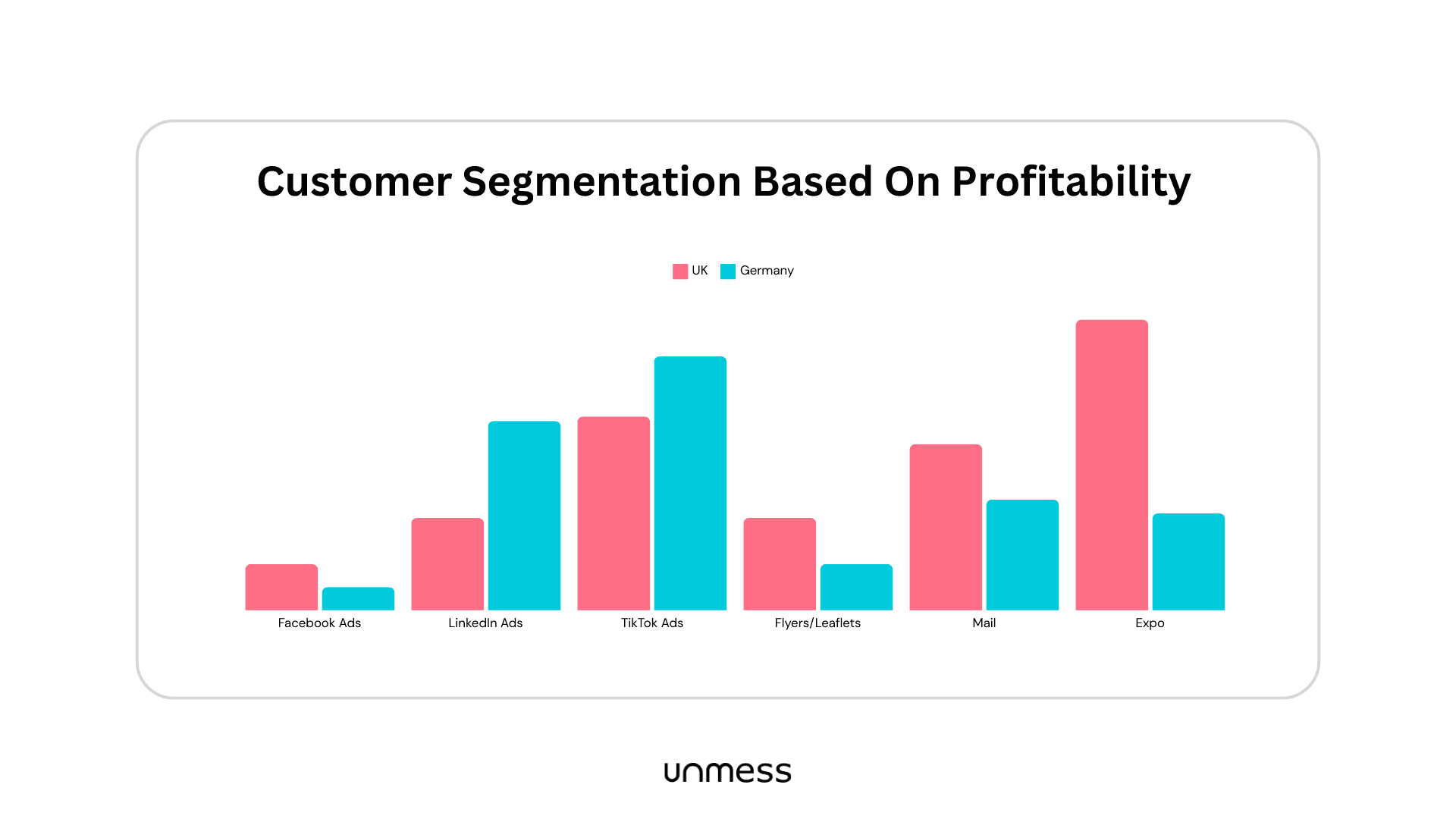

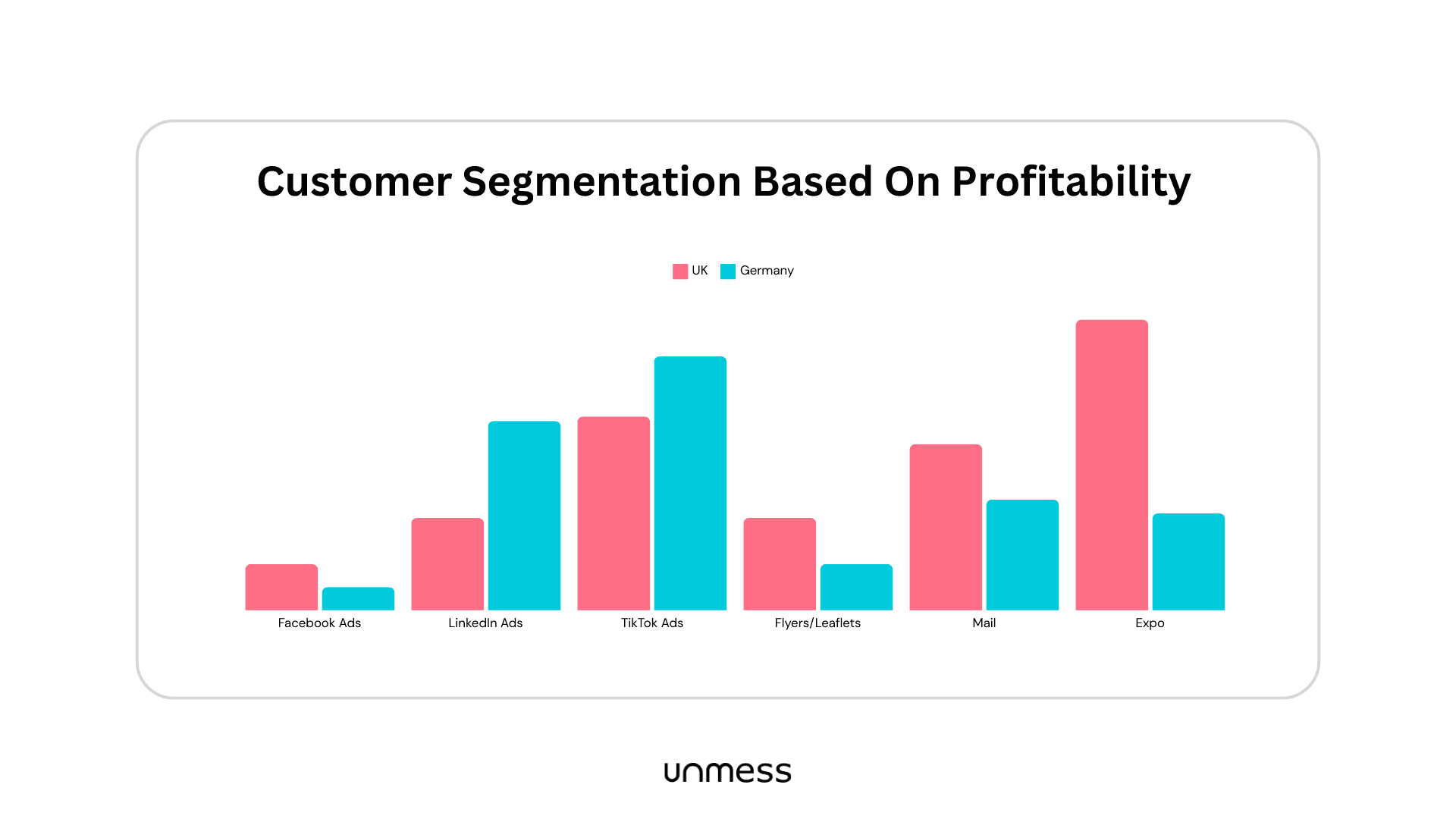

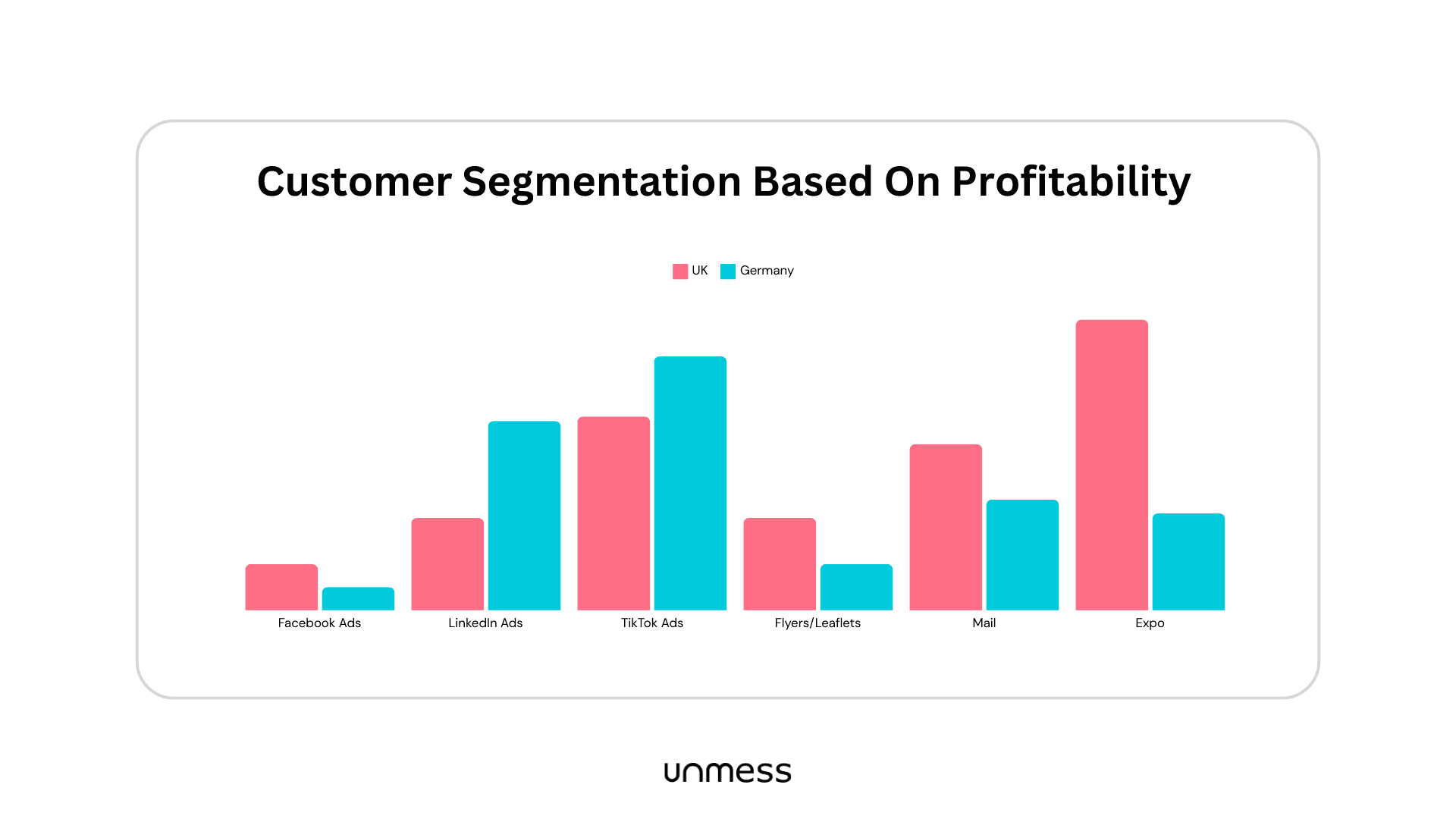

A closer look at customer profitability can reveal surprising insights. For example, a SaaS company serving both German and UK markets might find that customers acquired through physical marketing campaigns in Germany generate significantly higher recurring revenue compared to those obtained via digital channels in the UK. This could be due to factors like higher willingness to pay or lower churn rates among the German customer base.

On the other hand, the company may also identify a segment of price-sensitive users in the UK who rarely upgrade their subscriptions, despite representing a sizable portion of the customer base. Meanwhile, a third segment might be made up of high-volume, low-churn users across both regions, contributing the bulk of the company's profits.

Without integrating financial data into the analysis, the company may struggle to distinguish these vastly different customer groups and end up with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the organization can develop a more nuanced understanding of its customer base and allocate resources accordingly.

Without integrating financial data, the company might struggle to distinguish these segments and may end up treating them with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the company can develop a more nuanced understanding of its customer base and allocate resources accordingly. This could involve offering tailored pricing and product bundles, prioritizing retention efforts for the high-value segment, and optimizing acquisition strategies for the less profitable segments.

The Benefits

Leveraging financial data in customer segmentation can deliver a range of benefits:

Improved resource allocation: Companies can focus their marketing, sales, and product development efforts on the areas with the highest potential for growth and return on investment.

Enhanced customer targeting: Organizations can create more personalized and effective marketing campaigns, tailoring their messaging and offerings to the specific needs and preferences of each segment.

Increased customer lifetime value: Businesses can implement strategies to nurture and retain their most valuable customers, leading to improved customer loyalty and higher lifetime value.

Optimized pricing and product strategies: Granular customer profitability data can inform pricing decisions, product bundling, and feature prioritization, ensuring that companies are maximizing their revenue and margins.

Streamlined operations: Insights from financial data-driven segmentation can help organizations identify and address inefficiencies in their operations, such as high customer acquisition costs or suboptimal customer support processes.

Implementing Financial Data-Driven Segmentation

Integrating customer and financial data for effective segmentation can be a complex undertaking, but the benefits make it a worthwhile investment. Here are some key steps to implement this strategy:

Identify relevant financial and customer metrics: Determine the key financial and customer behavior metrics that are most relevant to your business model, such as revenue, profitability, customer acquisition cost, lifetime value, and churn rate.

Align data sources: Break down data silos by integrating customer data from various touchpoints (e.g., sales, marketing, customer service) with your financial data. Tools like unmess can help automate this process and assign costs to individual customer actions.

Analyze customer profitability: Perform in-depth analyses to understand the profitability of your customer segments, factoring in both revenue and costs associated with each customer's interactions and lifecycle.

Develop customer personas: Use the insights from your financial data-driven segmentation to create detailed customer personas, highlighting the unique characteristics, behaviors, and financial contributions of each segment.

Optimize strategies and tactics: Leverage your customer personas to inform your marketing, sales, product, and customer service strategies, ensuring that you're allocating resources and tailoring your approach to the needs of your most valuable customers. For a deeper understanding of how focused analysis can drive these outcomes, see our article on Why Spending More Time on Analysis Will Boost Your Revenue.

Conclusion

Businesses can gain a more comprehensive understanding of their customer base and make more informed strategic decisions. This data-driven approach to customer segmentation enables companies to identify their most profitable customer segments, develop targeted strategies, and drive sustainable growth.

Tools like unmess can simplify the process of aligning customer and financial data, providing finance teams with the insights they need to bridge the gap between customer behavior and financial performance. By automating the assignment of costs to individual customer actions, unmess empowers businesses to build a detailed, bottom-up profit and loss statement that accurately reflects the true profitability of their customer base.

Leveraging the power of financial data-driven segmentation can transform a company's approach to marketing, sales, product development, and customer service, ultimately leading to improved overall business performance. By understanding the true drivers of customer value and profitability, businesses can make more informed decisions, optimize resource allocation, and deliver superior customer experiences that foster long-term loyalty and growth.

While traditional financial reporting provides essential insights, it can fall short in capturing the full breadth of a company's performance. By incorporating additional customer data and metrics, businesses can gain a more comprehensive understanding of their operations and financial health.

Customer Metrics for financial analysis

Effective customer segmentation is essential for businesses to target the right audiences, allocate resources efficiently, and drive profitable growth. Traditionally, customer segmentation has been based on demographic, psychographic, or behavioral data. While these approaches provide valuable insights, they don't necessarily reveal the true drivers of customer value and profitability.

By incorporating financial data into the segmentation process, businesses can uncover profitability patterns and develop more accurate customer personas. This data-driven approach allows companies to identify their most valuable customer segments, understand the characteristics that make them profitable, and tailor their strategies accordingly. In fact, understanding these profitability patterns is key, as discussed in our article on “A Deep Dive into Customer Segmentation”.

A closer look at customer profitability can reveal surprising insights. For example, a SaaS company serving both German and UK markets might find that customers acquired through physical marketing campaigns in Germany generate significantly higher recurring revenue compared to those obtained via digital channels in the UK. This could be due to factors like higher willingness to pay or lower churn rates among the German customer base.

On the other hand, the company may also identify a segment of price-sensitive users in the UK who rarely upgrade their subscriptions, despite representing a sizable portion of the customer base. Meanwhile, a third segment might be made up of high-volume, low-churn users across both regions, contributing the bulk of the company's profits.

Without integrating financial data into the analysis, the company may struggle to distinguish these vastly different customer groups and end up with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the organization can develop a more nuanced understanding of its customer base and allocate resources accordingly.

Without integrating financial data, the company might struggle to distinguish these segments and may end up treating them with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the company can develop a more nuanced understanding of its customer base and allocate resources accordingly. This could involve offering tailored pricing and product bundles, prioritizing retention efforts for the high-value segment, and optimizing acquisition strategies for the less profitable segments.

The Benefits

Leveraging financial data in customer segmentation can deliver a range of benefits:

Improved resource allocation: Companies can focus their marketing, sales, and product development efforts on the areas with the highest potential for growth and return on investment.

Enhanced customer targeting: Organizations can create more personalized and effective marketing campaigns, tailoring their messaging and offerings to the specific needs and preferences of each segment.

Increased customer lifetime value: Businesses can implement strategies to nurture and retain their most valuable customers, leading to improved customer loyalty and higher lifetime value.

Optimized pricing and product strategies: Granular customer profitability data can inform pricing decisions, product bundling, and feature prioritization, ensuring that companies are maximizing their revenue and margins.

Streamlined operations: Insights from financial data-driven segmentation can help organizations identify and address inefficiencies in their operations, such as high customer acquisition costs or suboptimal customer support processes.

Implementing Financial Data-Driven Segmentation

Integrating customer and financial data for effective segmentation can be a complex undertaking, but the benefits make it a worthwhile investment. Here are some key steps to implement this strategy:

Identify relevant financial and customer metrics: Determine the key financial and customer behavior metrics that are most relevant to your business model, such as revenue, profitability, customer acquisition cost, lifetime value, and churn rate.

Align data sources: Break down data silos by integrating customer data from various touchpoints (e.g., sales, marketing, customer service) with your financial data. Tools like unmess can help automate this process and assign costs to individual customer actions.

Analyze customer profitability: Perform in-depth analyses to understand the profitability of your customer segments, factoring in both revenue and costs associated with each customer's interactions and lifecycle.

Develop customer personas: Use the insights from your financial data-driven segmentation to create detailed customer personas, highlighting the unique characteristics, behaviors, and financial contributions of each segment.

Optimize strategies and tactics: Leverage your customer personas to inform your marketing, sales, product, and customer service strategies, ensuring that you're allocating resources and tailoring your approach to the needs of your most valuable customers. For a deeper understanding of how focused analysis can drive these outcomes, see our article on Why Spending More Time on Analysis Will Boost Your Revenue.

Conclusion

Businesses can gain a more comprehensive understanding of their customer base and make more informed strategic decisions. This data-driven approach to customer segmentation enables companies to identify their most profitable customer segments, develop targeted strategies, and drive sustainable growth.

Tools like unmess can simplify the process of aligning customer and financial data, providing finance teams with the insights they need to bridge the gap between customer behavior and financial performance. By automating the assignment of costs to individual customer actions, unmess empowers businesses to build a detailed, bottom-up profit and loss statement that accurately reflects the true profitability of their customer base.

Leveraging the power of financial data-driven segmentation can transform a company's approach to marketing, sales, product development, and customer service, ultimately leading to improved overall business performance. By understanding the true drivers of customer value and profitability, businesses can make more informed decisions, optimize resource allocation, and deliver superior customer experiences that foster long-term loyalty and growth.

While traditional financial reporting provides essential insights, it can fall short in capturing the full breadth of a company's performance. By incorporating additional customer data and metrics, businesses can gain a more comprehensive understanding of their operations and financial health.

Customer Metrics for financial analysis

Effective customer segmentation is essential for businesses to target the right audiences, allocate resources efficiently, and drive profitable growth. Traditionally, customer segmentation has been based on demographic, psychographic, or behavioral data. While these approaches provide valuable insights, they don't necessarily reveal the true drivers of customer value and profitability.

By incorporating financial data into the segmentation process, businesses can uncover profitability patterns and develop more accurate customer personas. This data-driven approach allows companies to identify their most valuable customer segments, understand the characteristics that make them profitable, and tailor their strategies accordingly. In fact, understanding these profitability patterns is key, as discussed in our article on “A Deep Dive into Customer Segmentation”.

A closer look at customer profitability can reveal surprising insights. For example, a SaaS company serving both German and UK markets might find that customers acquired through physical marketing campaigns in Germany generate significantly higher recurring revenue compared to those obtained via digital channels in the UK. This could be due to factors like higher willingness to pay or lower churn rates among the German customer base.

On the other hand, the company may also identify a segment of price-sensitive users in the UK who rarely upgrade their subscriptions, despite representing a sizable portion of the customer base. Meanwhile, a third segment might be made up of high-volume, low-churn users across both regions, contributing the bulk of the company's profits.

Without integrating financial data into the analysis, the company may struggle to distinguish these vastly different customer groups and end up with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the organization can develop a more nuanced understanding of its customer base and allocate resources accordingly.

Without integrating financial data, the company might struggle to distinguish these segments and may end up treating them with a one-size-fits-all approach. However, by combining customer behavior metrics with profitability data, the company can develop a more nuanced understanding of its customer base and allocate resources accordingly. This could involve offering tailored pricing and product bundles, prioritizing retention efforts for the high-value segment, and optimizing acquisition strategies for the less profitable segments.

The Benefits

Leveraging financial data in customer segmentation can deliver a range of benefits:

Improved resource allocation: Companies can focus their marketing, sales, and product development efforts on the areas with the highest potential for growth and return on investment.

Enhanced customer targeting: Organizations can create more personalized and effective marketing campaigns, tailoring their messaging and offerings to the specific needs and preferences of each segment.

Increased customer lifetime value: Businesses can implement strategies to nurture and retain their most valuable customers, leading to improved customer loyalty and higher lifetime value.

Optimized pricing and product strategies: Granular customer profitability data can inform pricing decisions, product bundling, and feature prioritization, ensuring that companies are maximizing their revenue and margins.

Streamlined operations: Insights from financial data-driven segmentation can help organizations identify and address inefficiencies in their operations, such as high customer acquisition costs or suboptimal customer support processes.

Implementing Financial Data-Driven Segmentation

Integrating customer and financial data for effective segmentation can be a complex undertaking, but the benefits make it a worthwhile investment. Here are some key steps to implement this strategy:

Identify relevant financial and customer metrics: Determine the key financial and customer behavior metrics that are most relevant to your business model, such as revenue, profitability, customer acquisition cost, lifetime value, and churn rate.

Align data sources: Break down data silos by integrating customer data from various touchpoints (e.g., sales, marketing, customer service) with your financial data. Tools like unmess can help automate this process and assign costs to individual customer actions.

Analyze customer profitability: Perform in-depth analyses to understand the profitability of your customer segments, factoring in both revenue and costs associated with each customer's interactions and lifecycle.

Develop customer personas: Use the insights from your financial data-driven segmentation to create detailed customer personas, highlighting the unique characteristics, behaviors, and financial contributions of each segment.

Optimize strategies and tactics: Leverage your customer personas to inform your marketing, sales, product, and customer service strategies, ensuring that you're allocating resources and tailoring your approach to the needs of your most valuable customers. For a deeper understanding of how focused analysis can drive these outcomes, see our article on Why Spending More Time on Analysis Will Boost Your Revenue.

Conclusion

Businesses can gain a more comprehensive understanding of their customer base and make more informed strategic decisions. This data-driven approach to customer segmentation enables companies to identify their most profitable customer segments, develop targeted strategies, and drive sustainable growth.

Tools like unmess can simplify the process of aligning customer and financial data, providing finance teams with the insights they need to bridge the gap between customer behavior and financial performance. By automating the assignment of costs to individual customer actions, unmess empowers businesses to build a detailed, bottom-up profit and loss statement that accurately reflects the true profitability of their customer base.

Leveraging the power of financial data-driven segmentation can transform a company's approach to marketing, sales, product development, and customer service, ultimately leading to improved overall business performance. By understanding the true drivers of customer value and profitability, businesses can make more informed decisions, optimize resource allocation, and deliver superior customer experiences that foster long-term loyalty and growth.